Is Switching Banks Worth The Time & Energy Required?

This post may have affiliate links. Please read the Disclosure Policy for complete details.

I don’t know how long I’ve been with my current bank.

I bank with Wells Fargo but opened the account when it was still Wachovia.

My checks are still the original ones from Wachovia, too!

They merged in 2008, so it’s been at least that long.

Have I ever considered switching banks?

Heck yeah, I have!

Obviously, I’ve never pulled the trigger on that.

I honestly think about switching banks every couple of years.

There are several reasons I don’t do it, though.

And that’s what I want to discuss here–what you should think about before you go forward switching banks.

When Should You Consider Switching Banks?

This is the million-dollar question!

Just like any other financial advice, nothing is going to apply to all people.

Some people will think about switching banks if they plan on moving.

Others because they had a bad experience at their current/former financial institution.

Still, others feel they have outgrown it.

Some people think they are “entitled” to special treatment.

There is an endless number of reasons why someone would want to switch banks.

I try to apply this reasoning to my biggest decisions:

Why did I do this in the first place?

I use that question to try and curb emotional investing decisions.

So in this case, you would ask yourself why you chose your current bank in the first place.

Was it a convenient location?

Was it the availability of bank drive-thru services?

Was it because that’s where your parents took you?

Whatever the reason, if that didn’t change then perhaps you shouldn’t even consider switching banks.

Kind of like the “if it isn’t broke…” theory.

The bottom line is that you have to determine for yourself if your current bank is still meeting your needs or if you should switch banks.

Switching Banks May Require Compromises

If, after analyzing your why for switching banks, you still want to proceed, then you have to think about what you may be giving up.

You would have to find another bank that offers exactly what you are looking for all under one roof.

That is very rare these days.

Let’s say that you are a long-time account holder of a totally-free checking account (ie: no minimum balance and no cap on the number of transactions you can make) and your bank no longer offers that type of account.

Then they implement a monthly fee for having an ATM/debit card which you strenuously object to paying.

You have the option to give up the card and save the monthly fee, or you can leave.

If you leave because of the fee, you may be able to find the account you are looking for at, say a local credit union, but then you may be giving up the ease of access since most credit unions don’t have a large number of branches (and this is especially difficult if you travel often).

Or you may end up having to accept:

- Lower mobile deposit or online transfer limits

- Limited online banking options

- No connection to budgeting apps (I know of a credit union where the checking accounts work with QuickBooks Online but a savings account won’t)

- Fees for connecting to 3rd party apps

- A limited number of free teller transactions

These are just a few of the possible concessions you may have to make by switching banks.

Many people don’t stop to think about things like this, but it’s important to consider all of the consequences of making decisions, especially about switching banks.

Switching Banks Means Tons of Housekeeping

Another thing to consider is how interconnected life is.

Not just in life, but when it comes to managing money!

Every account that you have linked to your existing bank account(s) would have to be changed manually to link to the new one.

That means:

- Other financial institutions

- Brokerages

- PayPal

- Credit cards

- Utility companies

- Cell phone providers

- Student loan servicers

- Mortgage providers

- Car payment servicer

- Stores

- Homeowner and auto insurance agencies

- Anyone to whom you pay with auto payment or online will have to be contacted in some way to be notified

It’s important to make sure you account for everything.

If you close your account too early you may have payments that get rejected due to the account not existing, incurring NSF fees.

On the other hand, if you wait too long and end up forgetting to clear the account out, it can be closed and the monies sent to the state as unclaimed property.

In some cases, you may have a couple of billing cycles in which you have to pay manually as not all services update immediately.

And, let’s not forget your direct deposits will have to be updated with your employer or their payroll company so you continue to get paid!

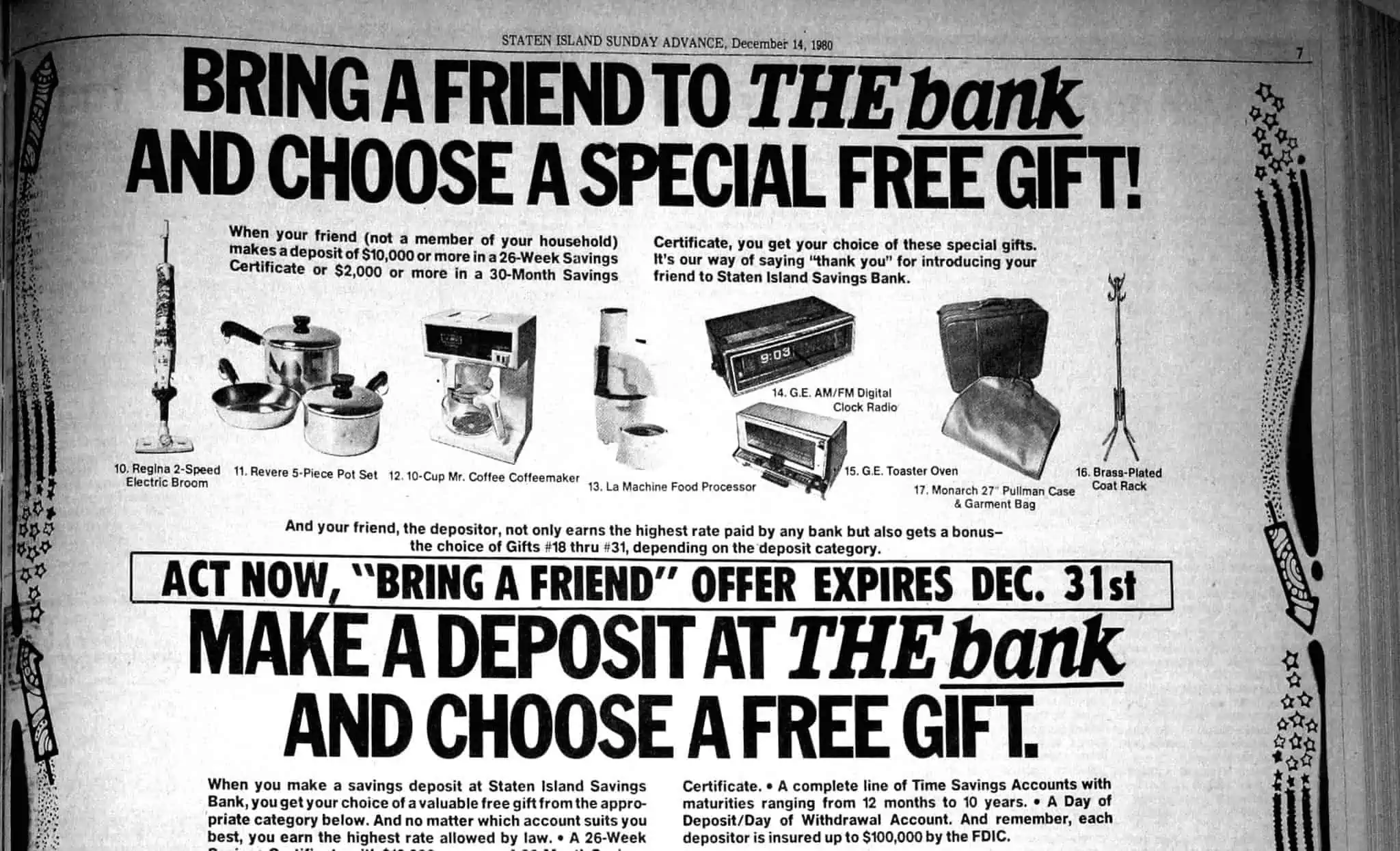

Bank Promotions For Switching

Some banks will offer you a “bribe” to move your money.

It can actually be pretty lucrative depending on the particular bank and the offer.

It used to be (as recently as the mid-2000s) that you would simply have to open a new account when switching banks to get the promotions.

Going back even further, like in the above ad, you can consider it the original version of affiliate marketing!

Granted, back then you were getting things like Pyrex sets, toaster ovens, or blenders but those were pretty pricey in those days.

Today’s promotions for switching banks normally involve cash bonuses.

You may get different amounts for different tiers of bank accounts.

For example, interest checking accounts with high minimums & fees will generally pay out more than a simple savings account.

It might seem a lot more exciting than small appliances!

But now, you have to be prepared to jump through a bunch of hoops to get those bank bonuses.

Here’s one particular bank promotion:

- Open a new checking account

- Deposit a minimum of $2,000 within 30 days

- Maintain a $2,000 balance for 60 days

- Make 5 qualified transactions within 90 days

For this particular bank a “qualified transaction” includes:

- Debit card purchases

- Mobile deposits

- ACH credits

- Wire debits & credits

That means regular deposits, checks, and e-checks/ACH debits apparently don’t count.

Plus it’s at least going to be a 60-90 day completion period, with who-knows-how-long the timeframe is to actually receive the money.

That is a very stark difference from the old-school bank promotions, that’s for sure!

Also, I want to make this 100% clear:

Bank promotions are reportable on your income tax return and also if you have a state income tax too!

Wrapping Up

Look, you may be unhappy with your bank, and I get that.

You may want to support a local business, and I get that, too.

Heck, you may simply be in the mood to make some “free” cash.

Whatever the reason for you to be switching banks, I want you to be aware of all of the things you will face in doing so.

Trust me, I’ve worked with a lot of people who have gone through that process and it can be a lot of work.

Just take the time to familiarize yourself with what you will have to do and have a plan before making the final decision!

Your Turn

If you have gone through the process of switching banks, what was your experience like? If you did or are thinking about moving over to a different bank, what is your reasoning?