Investing In Collectibles: 100% Fun But Can Be Costly

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Investing in collectibles has breathed new life into some long-dormant industries over the last few years.

It can be a fun and different approach to building wealth.

Gary Vaynerchuk has been championing sports cards for some time now.

Twitch streamers and YouTubers have been jumping into the Pokémon card and unopened Pokémon box markets in droves.

Numerous YouTube channels are popping up (in addition to the many with long histories) dedicated to comic books in general as well as graded comic books.

There’s more:

- classic toys

- stamps

- coins

- wine

- art

- antiques

- all other collectibles

For some, it’s a way to relive their childhood.

For others, it’s a way to explore a new hobby.

Overall, many people view investing in collectibles of all kinds as just that…an investment.

It’s not all fun and games, however.

I see it all too often, particularly with the younger streaming crowd who are dropping tens of thousands of dollars on unopened Pokemon boxes.

Not to be a downer, but there are significant risks, as well as a pretty hefty capital requirement to get started.

Plus, there are things to consider that no one seems to talk about probably because it won’t attract viewers.

Let’s look at the realities and downsides of investing in collectibles for some balance because I really don’t feel like a lot of people are aware of the downsides.

Learn About Supply And Demand When Investing In Collectibles

This to me is one of the biggest things people do not understand when getting into investing in collectibles.

This is especially true for the Pokémon card and Pokémon unopened box groups.

I keep hearing people talk about getting the $250k 1999 Base 1st Edition Charizard or some Hologram Dark Charizard or whatever other card they are chasing from unopened Pokémon boxes.

It makes me literally yell at the TV or computer screen–I watch YouTube videos and Twitch streams on my Apple TV while chilling or eating which is why I said TV.

Side note: that stuff replaces cable television as my TV-related entertainment since I eliminated it (cable) from my list of utility bills.

I get that most people aren’t finance or economics experts, so let’s lay it out quickly:

The reason these cards are going for such high prices is because of their rarity.

There just simply aren’t a lot of them in the market right now.

But, as people keep breaking (opening) boxes, more and more will be discovered and flood the market.

As more of them come out, the sales values will drop–some slightly, some greatly.

Why?

Because they are now not as rare and therefore not as valuable.

What will happen is a shift in value…instead of the individual cards, the unopened Pokémon boxes will now start to skyrocket in value.

Why?

Everyone started breaking open their boxes to chase the individual cards, so now unopened Pokémon boxes are the rare items.

This exact scenario applies to sports cards as well.

This isn’t to say that the individual cards won’t be valuable, it’s just that they will be less valuable as more of them hit the open market.

It’s important to keep this in mind because another factor people aren’t speaking about is up next.

Investing In Collectibles Isn’t Safe From Bubbles/Crashes

The stock market crashes from time to time.

There have been numerous housing crashes.

No investment is ever “safe”.

If you want a safe place to put your money look into a CD ladder or some other bank account.

When investing in collectibles, you need to be aware that this is no different.

In 1993, the comic book market had a crash that crippled the industry.

The 1990s were an interesting time for the comic book industry:

- The number of titles multiplied

- Independent publishers popped up

- New, “variant” covers started being published

- Monthly price guides appeared on the scene

- Sales increased exponentially

Those last two points are the really important ones.

First, Wizard: The Guide to Comics started being published in July of 1991 giving collectors a new way to look at their comic book collection.

People started looking at comic books like you are today: investing in collectibles is more than simply entertainment.

Now “collectors” started turning into “speculators” and purchasing multiple copies of the same issue.

That led to a huge, albeit false, signal to stores and publishers to increase orders and print runs.

It was too late before the industry realized the truth.

The sales being reported weren’t individual purchases signaling the growth of the industry, but a smaller group of people buying multiples.

So now you had the publishers flooding the market as stores increased the volume of their orders without the people to buy all of this stock.

That led to a collapse of the market and drove many stores out of business under the weight of the inventory that simply couldn’t be moved.

Something similar happened with the sports card industry in the same time period.

(This is a very simplified summary)

For most of the 1900s, it was just Topps manufacturing the majority of sports cards (O-Pee-Chee in Canada for hockey cards specifically).

Then, in the 1980s Donruss and Fleer entered the market and Upper Deck was “born” in 1989.

When the 1990s got underway, the companies needed to find a way to differentiate themselves so, like comic books, “variants” became popular as well as insert sets–special types of cards not part of the regular base set of cards.

Between the volume of the base set print runs diluting the market and the many different types of inserts, the overall market collapsed.

There were also external factors, especially in the baseball card market, when Barry Bonds, Roger Clemens, and a host of others saw their names tied to performance-enhancing drugs and battering the values of not only their cards but everyone’s.

Sports card stores followed the same route as the comic book stores after this.

Again, it’s important to remember that investing in collectibles is just like any other investment–it comes with risk.

Timing Is Important When Investing In Collectibles

Obviously, timing is always important.

And also obviously is the fact that you cannot time the market.

But that’s not what I’m talking about.

I’m actually talking about graded comic books, graded Pokémon cards, and graded sports cards.

The highest values when investing in collectibles come from getting the items graded.

This involves sending the collectibles into PSA or CGC, the two largest and most recognized grading services when it comes to sports cards or Pokémon cards and comic books, respectively.

The grader will examine the collectible you send, assign it a grade, and encase it in a thick, protective “slab” with a label containing the information about it.

These are the items that truly drive the desire for people to invest in collectibles.

The problem is timing…nothing is immediate.

If you are looking to make a quick sale to take advantage of a “pop” you may be disappointed to learn that the turnaround time could be up to a few months.

By the time you get that card or comic book back, the market for it could have cooled or possibly even died.

Let’s look at New Mutants comic books for example.

When the announcement was made that Fox Studios was going to turn one of the stories into a movie, the prices went up.

When word came out that there were issues with the director and how the filming was going, the market stalled.

Then you had an announcement that the release date was being pushed back not once, but twice to do massive reshoots, and the prices for New Mutants comics came back down.

As someone who is investing in collectibles, you are interested in buying low and selling high, but because of the time, it takes to grade comics yours may have been at CGC when one of the negative announcements was made.

Through no fault of your own, when you got it back, you may have been holding a losing investment simply because it takes time for the grading process.

Sure, you can pay for a faster turnaround, but as in investment, you have to consider the impact of the added cost on your bottom line.

Also, there are things that you simply cannot control, even with money lol.

If a lot of people are submitting their own Pokémon cards, sports cards, or comic books for grading then the turnaround time will naturally increase even for the higher-cost, quicker turnaround service levels.

So please keep all of this in mind if you are trying to profit off of a hot trend.

Investing In Collectibles Costs More Than You Realize

Obviously, any investment or purchase is going to require money.

The issue I’m referencing goes well beyond that.

We already talked about getting your collectibles graded, and it’s a wise choice because it not only provides protection but also increases the value if they are in the best condition.

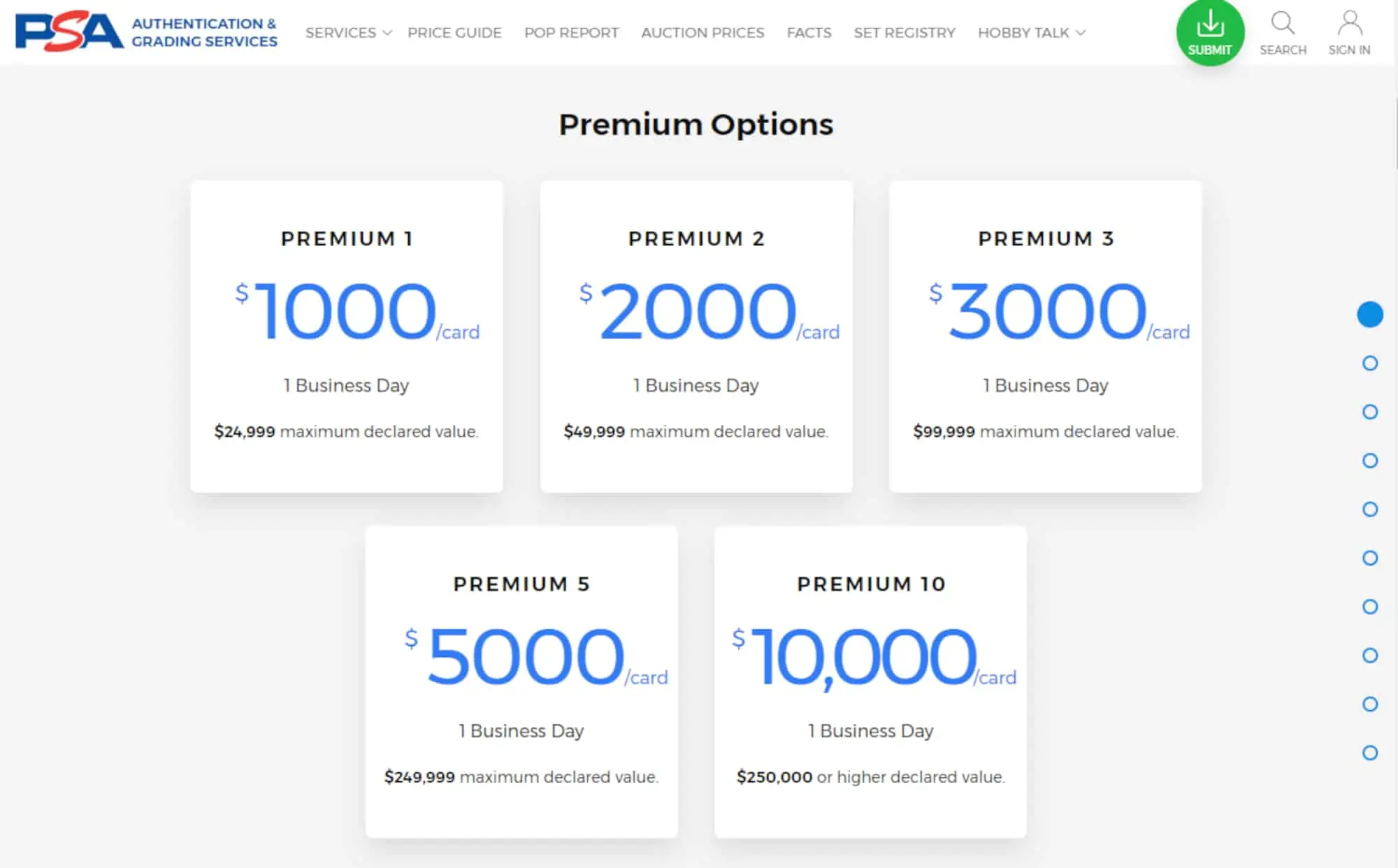

What I don’t think people understand is that it costs money–sometimes a lot of money–to get stuff graded.

Many items are priced based on age and value.

So, let’s say you have one of those holy grails of trading cards or comics that is valued highly.

If you look at the pricing schedule below from PSA for cards valued above $10k you will see what it will cost:

You may have saved for a year to buy the box from which one of those cards came out but now you have to come up with at least another $1k just to cover the grading.

A lot of people don’t get it or relay this info when discussing hunting for boxes of comics in the wild.

I want you to understand what you are in for when you are investing in collectibles and are not flush with cash to spend.

Investing In Collectibles + Taxes

You didn’t think we were going to avoid talking about income taxes, did you?

You may or may not already know about capital gains tax on “traditional” investments like stocks, bonds, mutual funds, etc.

There is also a capital gains tax when you are investing in collectibles, too.

Since this isn’t a tax article, I’ll try to keep it simple and brief but, as always, you should always consult a tax accountant who is knowledgeable in this area for help.

If you are a “collector” investing in collectibles–meaning you aren’t in the business of selling collectibles like Pokémon cards, comic books, or sports cards–then you MAY have to report the income on your income tax return.

That means the difference between what you paid for the item and what you sold it for.

You don’t get to deduct expenses as a business does for rent, supplies, etc.

You can, however, take into account grading costs, pressing & dry cleaning, shipping, and dealer/broker/sales fees to help offset the gain.

That tax is going to be based on how long you owned the card/comic.

If you owned it for less than a year it’s considered a short-term capital gain and taxed at whatever your federal income tax rate is.

If you held the item for more than a year it’s considered a long-term capital gain and is taxed at that special collectibles tax rate.

And don’t forget about state income tax, too!

I strongly suggest you speak to a qualified tax preparer to find out what your tax consequences of investing in collectibles are going to be and to see if starting a business will help in that regard.

Wrapping Up

Investing in collectibles can definitely be a fun thing.

It can be exhilarating to open that pack to find the “holy grail”.

Or to flip through that collection of comics in a long box and find a “double key”

It can be exciting to get a card or comic back from a grading service with a 9.8 for most comics or 10 for cards.

But investing in collectibles can also come with a lot of headaches like those we discussed above.

Just try to keep everything from above in mind and don’t get too ???!

Your Turn

What are your thoughts on investing in collectibles? Is it something you do? Something you’ve considered? Have you anything from your childhood that you still possess that fits the bill?