Limited Liability Company (LLC) Formation: DIY To Save Time & Money

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Before you lock in your business name by registering it, you may want to read my article about coming up with a name for your business so you don’t register something that you can’t get any kind of related online presence for!

People often ask me about forming a business.

That mostly involves a discussion around forming a limited liability company.

Eventually, the conversation takes an ugly turn.

A turn toward incorporation firms:

- What they do.

- Why people should use them.

- If they’re worth the cost.

- Which ones are trustworthy.

You’ve no doubt seen them marketed before.

You probably visited a website or two as well.

I personally hate them.

Yes, hate!

You’re so much better off forming a limited liability company yourself and saving the money to reinvest in the business.

Limited Liability Company Misconceptions

Before we get into the meat of all this stuff, I want to clear up a couple of misconceptions regarding forming a limited liability company that gets thrown around pretty freely.

First and foremost, it’s important to know that a limited liability company (or any “incorporated” structure) is solely a legal issue.

All of these things are designed to create entities separate from the people running them for asset and legal protections.

That’s why you have to go through a state to form a business rather than the IRS–the IRS has nothing to do with the entities whatsoever. You will never be told by the IRS “what form of business you need to be”.

With that said, you want to speak to an attorney to see which legal structure will be best for your particular needs based on your personal assets/finances as well as what your plan is for the business in the future–not an accountant.

Secondly, single-member LLCs are treated the same way as a sole proprietorship for federal tax purposes.

Due to that like treatment, there is no monetary threshold for “when you should form a limited liability company”.

Again, the structure is strictly about making an entity separate from those who run it so if you need those protections, you do it regardless of income or profit.

Now that the BS is put to rest, let’s get going with the goal of showing you why you should do your own limited liability company formation and save yourself a buttload of time and money!

How Business Formation Services Work

On the surface, business incorporation services look like great resources.

In some cases it is.

For example: if you have a complex business structure or have foreign people involved, or operate in multiple states this would be a great way for you to get the job done without worrying if you forgot any info.

But for the majority of people, and especially those of you reading this very site, it’s totally unnecessary.

First, you think you’re paying an exorbitant amount for a simple service like business formation.

Then when you’re finished with the state-required info, the shitstorm begins.

Right off the bat, you’re presented with options for services that seem like requirements for a limited liability company that isn’t, such as business documentation services or online registration.

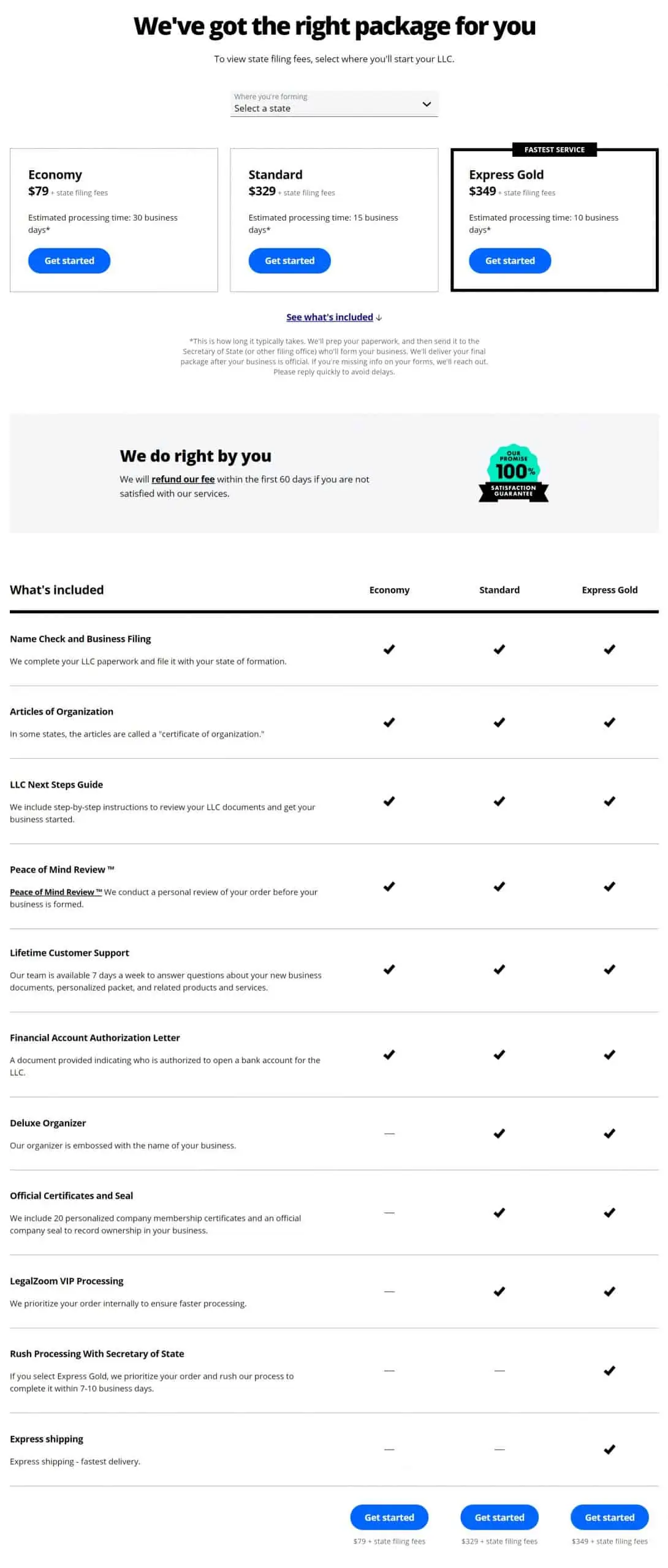

Looking at LegalZoom, first, we notice the fees for a limited liability company starting at $79–and that’s for a 30-day turnaround (business days at that)–not including state filing fees.

You can get near-instant limited liability company formation with most states on your own–some may take a couple of days to process–but that’s without paying anything extra!

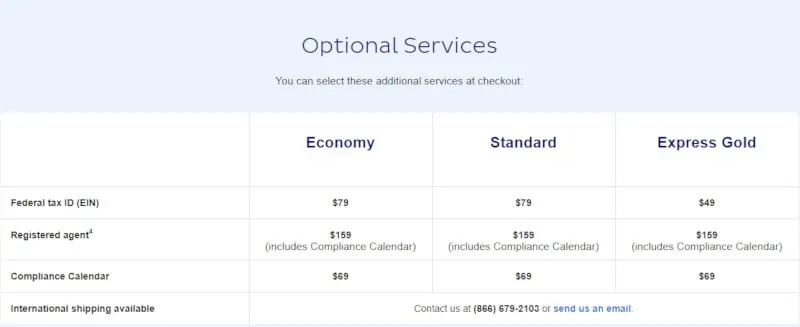

Then you are presented with services that are add-on charges but are totally free, and again, very simple to accomplish on your own like obtaining an EIN.

Take LegalZoom again; the company will charge you up to $79 for obtaining an EIN for your business and will send you compliance reminders for $69 (and that’s per year which isn’t specified nor does that service have any notation to signify there may be more info!).

For most people, it’s a total waste of money made to look like a business-saving service.

And do you know what you get from most of the incorporation services?

Nothing!

Well, maybe some will give you a binder with your incorporation documents and a corporate seal to make it look all official and worth the fee.

But the truth is, none of that stuff is relevant these days anyway.

The articles of incorporation or organization for your limited liability company are stored online in most states, and you can always just scan them if you do it by hand to keep a digital record.

Be honest now, how many of you even know what a corporate seal is or what it would be used for?

Unless you are filing articles for a complex organization, you can do your own limited liability company filing, and save the fees you would have otherwise spent for marketing, website design work, or any other business need.

Is Forming A Limited Liability Company Difficult?

Most, if not all states only require the bare minimum in order to register a limited liability company.

You basically just need a few pieces of information to be on your way:

- Company name, mailing & physical addresses

- Responsible party’s name & address

- Registered agent’s name & address

- Officer(s) or Member(s) (for a limited liability company) name(s) and address(es)

- Number of authorized shares (for an S-Corp)

- Sometimes you may need a business purpose but the standard line of “The purpose of the corporation is to engage in any lawful activity for which corporations may be incorporated in this state” almost always will suffice.

Heck, some states like Michigan don’t even require any information for the single-member LLC member/manager (the person who “owns” the company) or any person for that matter.

That’s really not a whole lot of information, and the difficulty of gathering it all is relatively non-existent, especially if you’re running a small business in which the same person acts in all of those capacities.

It literally takes all of 10 minutes max to complete the process.

Is saving 10 minutes really worth spending $100+!?

I don’t think so, and all of the people I’ve “helped” do it themselves didn’t think so either.

Disclaimer: By “helped”, all I did was hang on the phone with them as they filled out the forms. I honestly didn’t need to do a single thing for them!

Look, I’m the first to tell people to outsource tasks in which they aren’t experts or don’t have anything to do with making money.

That advice generally comes with 2 exceptions:

- You simply don’t have the free cash to pay for someone else to do the job, or

- It’s something you can absolutely do on your own without much time or effort spent

When it comes to incorporation–a small S-Corp or forming a single-member LLC or partnership–that latter exception comes into play.

Of course, there’s always a drawback to DIY, and particularly in business matters but. this is one of those times when you should be doing something on your own rather than outsourcing tasks.

Based solely on the simplicity of the task and how much you’ll be saving it is worth the few minutes that incorporating will take out of your day.

State Limited Liability Company Formation Resources

As I’ve said, the process of forming a limited liability company is relatively simple if you decide to do it yourself.

The most difficult part of my experience has been finding the exact website for each state to begin the process.

But, to make it super-easy (dare I say foolproof?) you have this handy-dandy chart that will take you to the exact page for each state.

That way you won’t mistakenly use a site that charges a service fee to “do it yourself”!

Just click on your state below to be taken to its central site for business registration:

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

District of Columbia

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Obtaining An EIN For Your Limited Liability Company

Remember that $79 to have the EIN obtained for you?

Well, it’s just as easy to get on your own…and for no cost!

All you do is visit the IRS Online EIN Application.

From there you simply enter much of the same information as you used when registering your business:

- Business name

- Member/Shareholder info

- State of incorporation

- Business structure (sole proprietorship, limited liability company, corporation, etc)

And then you’ll have to add just a few more pieces of info for classification purposes:

- Reason for applying (new biz, started hiring employees, change in structure)

- Employee info (if you will run payroll)

- Principal industry

- Specific product/service offering(s)

That’s pretty much all there is to it.

And the best part?

You get your brand new EIN on the spot–no need to wait.

Oh yeah, and if I hadn’t mentioned it before, obtaining an EIN yourself costs nothing!

DIY Limited Liability Company Formation Saves You Money

Let’s do a little math here:

- Minimum savings by incorporating yourself: $79.00

- Savings for getting your own business EIN: $79.00

Just by doing 2 things on your own, you will save at least $160.oo!

That’s a lot of money, especially if you are just starting out and putting your own cash into the business.

And the best part is that not only will you save money, but you’ll also save time.

The DIY methods yield practically instant results (sometimes it takes a day or two for the official documents to be available online).

But it sure as heck won’t take 30 days.

That means you can then turn around and get your new business its very own bank account and credit card without having to wait weeks for the incorporation service to “get around to your order”.

And the quicker you can get the nuts and bolts of your business in place, the quicker you can start getting to work making money!

But it doesn’t stop there, oh no, there’s much more to know…

Your Limited Liability Company & Taxes

Is there anything worse than paying taxes?

Obviously, there are.

The question is meant in terms of running a business.

Maybe not getting paid is worse.

Or perhaps not having any clients at all.

But generally speaking, paying taxes sucks big time!

Oh, wait, I got it.

How about paying taxes you didn’t know you even had to pay!?

That’s much worse.

And it can happen to you if you’re not careful.

Of course, you already know that.

In this case, however, I’m talking about something else entirely.

I’m talking about the state business tax you aren’t planning to owe for your Single-Member LLC and even worse…

The penalties you’ll likely be paying.

What You Know About Single-Member LLCs

We already covered this in the very beginning, but it’s worth reiterating.

The point of the single-member LLC is to provide legal separation and protection versus a regular old sole proprietorship.

It creates a legal entity completely separate from its “owner” or member.

Depending on your point of view, it also carries the benefit of going on Schedule C of your 1040 which streamlines the tax reporting process (since a separate return isn’t required).

That’s pretty much the extent of what the general public knows about this business entity type.

And that’s all correct.

What You May Not Know About Single-Member LLCs

There is a very big piece of the picture that most people are missing.

It’s especially true of those who don’t work with an accountant or attorney to set up their limited liability company.

Uninformed people giving “advice” on the subject–either on their own websites or on social media groups–only make matters worse.

The problem is the misconception that states follow the federal tax treatment of single-member LLCs.

What this means is that there are some states which don’t treat single-member LLCs as sole proprietorships for tax purposes.

For example:

Florida doesn’t have an individual state income tax and follows the federal treatment of single-member LLCs taxed as sole proprietorships. That means this type of business isn’t taxed at all in the state.

On the other hand, Texas doesn’t have a state income tax on individuals either but does require single-member LLCs that are federally taxed as sole proprietorships to file a franchise tax return (although up to certain earnings limits, no tax may be due).

A sole proprietorship that is not legally organized in a manner that limits its liability is not a taxable entity. A single-member limited liability company filing as a sole proprietor for federal income tax purposes is a taxable entity.

Texas Comptroller of Public Accounts

Similarly, Tennessee only taxes interest and dividends over $1,250 ($2,500 for married filing joint returns). However, even if you are a single-member LLC taxed as a sole proprietor, you have to register to pay franchise and excise taxes:

Entities disregarded for federal income tax purposes, except limited liability companies whose single member is a corporation, will not be disregarded for Tennessee franchise and excise tax purposes.

Tennessee Franchise and Excise Tax Guide

These are just a few examples of how states do or don’t follow the federal government’s lead.

Every state is going to be different so you need to pay attention to how yours operates.

How To Avoid State Income Tax Trouble

You don’t want to be in a position where you can’t pay your taxes.

You also don’t want to be in a position to pay unnecessary things such as penalties or interest.

There’s one simple way to avoid both situations:

Pay attention and do your due diligence.

If you’re going to be starting a business, make sure to do your homework.

Don’t take the word of random people on the internet.

Don’t assume that something on a blog or magazine site is valid because many times they only contain partial information (especially when it comes to tax-related info they only discuss federal tax advice)

Check your state’s Department of Revenue (or whichever division handles income taxes) to see what you are responsible for.

That way, you’ll be able to not only plan accordingly to hold aside money to pay taxes, but you’ll also avoid those unnecessary (and unsightly) failure-to-file or pay penalties.

Trust me, at some point, you’ll get caught!

Just by registering a limited liability company, you leave a trail for the state to follow right to your bank account.

So if you set up a limited liability company but fail to file your earnings report or tax return, you’ll eventually get one of those dreaded letters in the mail.

Knowledge is power, and in this case, it’s also money–money kept in your pocket!

Do yourself the biggest favor you can and challenge everything.

If someone tells you that you don’t need to file a report or pay taxes, ask them to show you the proof.

If someone says that your single-member LLC is exempt from state income taxes because it is exempt from federal income taxes, tell them to back it up with documentation.

And help others too!

When you see or hear someone elude to faulty assumptions like this, then set them straight so they don’t get into trouble themselves.

If paying taxes is one of the worst feelings, then knowing that you helped someone is one of the best.

Now that you’ve gotten the legal stuff taken care of for your limited liability company, it’s time to take control of your online identity.

Head on over right now and register your domains before someone else does! I register all of my domains with Namecheap. Why? It’s low-cost for all of your registration needs and offers monthly discounts. You’ll even get a promo code when you use that link!

Then get a hosting account and start building that online presence for your limited liability company! This site, as well as my business, is hosted with Siteground. Why? It has one of the best records in terms of up-time, has great support, and is affordable for even the smallest budget!

Your Turn

How have you gone about forming your limited liability company and obtaining your business EIN? Let us know what method you used and how it worked out for you…especially if you have/had multiple businesses and can compare the two methods for your fellow readers!