What To Do When You Wrongly Receive A 1099-NEC

This post may have affiliate links. Please read the Disclosure Policy for complete details.

This is a follow-up to my previous article about sending Form 1099-NEC when they aren’t required and how it can be costing you money and give your partners unnecessary work. This is the flip-side for those of you who are the ones on the receiving end.

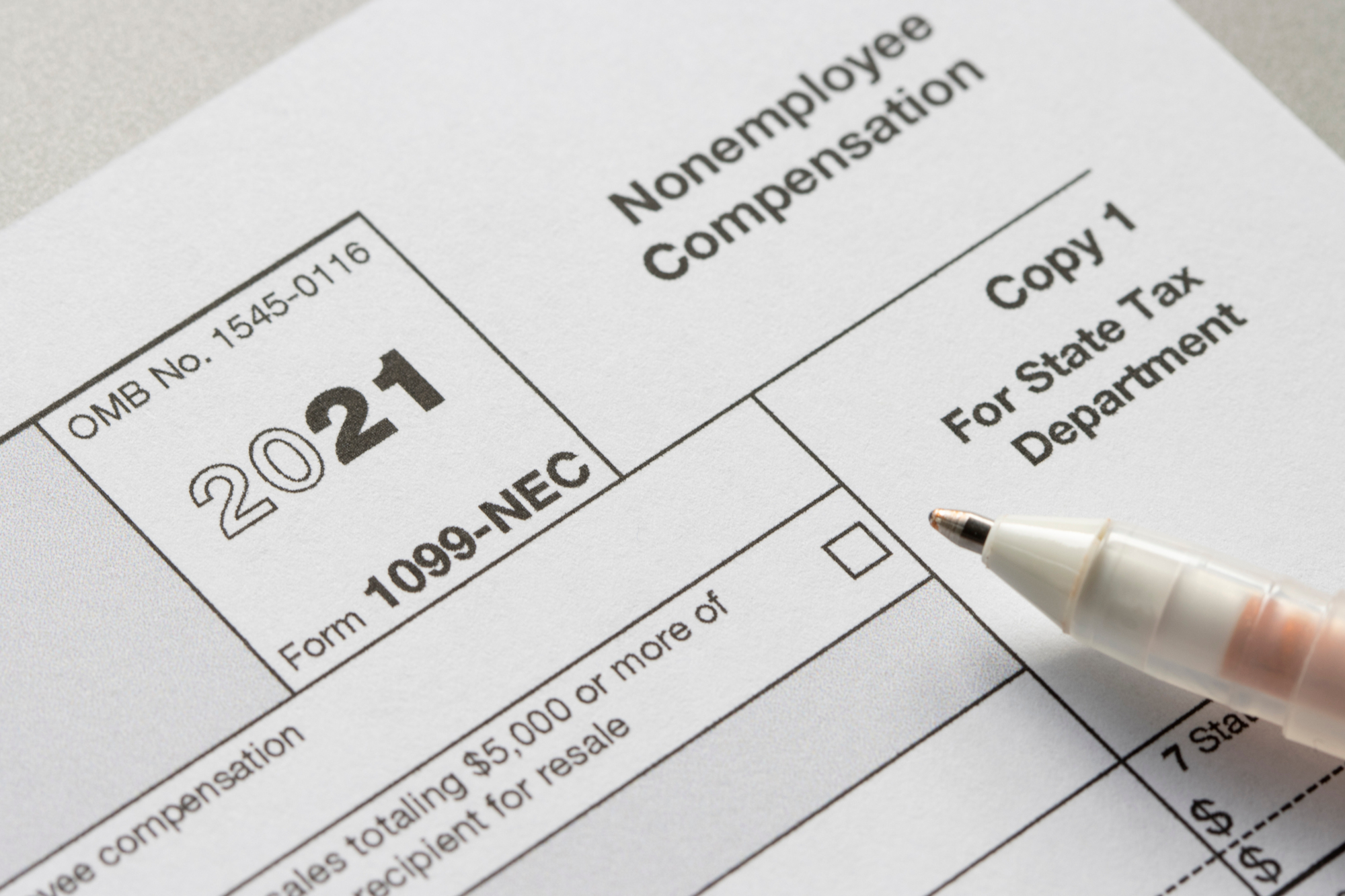

Also, for reference, a new old form is coming in 2020 called the 1099-NEC. For all intents and purposes, this is the form for paying independent contractors and freelancers going forward. The rules for the 1099-NEC are the same as for the 1099-MISC and the IRS still uses the “MISC” in many of its instructions.

One second you’re walking to the mailbox, not a care in the world.

The next second, you’re filled with dread.

You hold a letter from the IRS, your hand trembling.

Scared as you may be, you open it, hoping it’s not what you think.

Experienced freelancers will know some of this already.

If you are relatively new to freelancing, this may be totally new.

In either case, you’ll want to pay attention.

Why?

I can guarantee that if you haven’t personally, you know someone who has dealt with it.

And because I’m going to put your mind at ease about it.

So what is “it” already?

DOUBLE INCOME REPORTING.

And it can be a pain in the ass, not to mention scary as shit if you aren’t prepared.

Tax Forms You Need To Know About

I like to be thorough and not take anyone’s level of knowledge for granted, so bear with me for a second while I explain this to anyone who isn’t very familiar with the concept.

Hell, you self-taught experts may surprise yourselves with how much you didn’t know so you may want to read this all the way through too!

As a business owner/contractor, you aren’t treated the same as an employee.

You don’t get a regular paycheck with taxes taken out.

You don’t get a neat little W-2 at the beginning of the year summarizing your earnings and tax withholding in a single, neat document.

Instead, you are responsible for calculating and paying your own estimated taxes, getting a form 1099-NEC instead (if you earn $600 or more from any single partner for the year and paid via cash, check, bank transfer, or money-sharing app).

This can be loosely described as the non-employee version of a W-2, except it only shows income (no tax info since you do that independently of the people you work for).

You probably don’t even get a check or direct deposit at all.

Most likely you accept credit cards in your business.

Or get paid via a 3rd party payment processor such as PayPal.

In that case, you may get a Form 1099-K.

This form is quite different than the other two which were mentioned earlier.

A 1099-K is a form that payment processors send out to people who reach certain minimums in terms of transaction volume and the total value of receipts (200 transactions and $20,000).

So that’s a basic overview of the differences between all of the tax forms which you need to know about.

How Double Income Reporting Occurs

This is where things appear to get complicated, even though they aren’t, and shouldn’t.

And it’s not your fault whatsoever!

Every employer is required to send a copy of the W-2 to the IRS to match up with their income tax return.

It’s how the IRS knows that people (for the most part) are reporting what they earned and can’t cheat (although they always find a way).

The same thing happens any time a business or individual pays a non-employee more than $600…they send in a 1099-NEC to the IRS.

And if you qualify for a 1099-K–having in excess of 200 transactions AND more than $20k in gross billings running through a third-party payment processor like PayPal, Stripe, etc–a copy of that also goes to the IRS on your behalf.

But…wait just a second.

If you get both a 1099-NEC and a 1099-K, doesn’t that mean much more money is being reported than is actually being earned?

Ding ding ding ding!

That’s where you’re getting screwed over in a sense.

And why is that?

Here are the reasons for that:

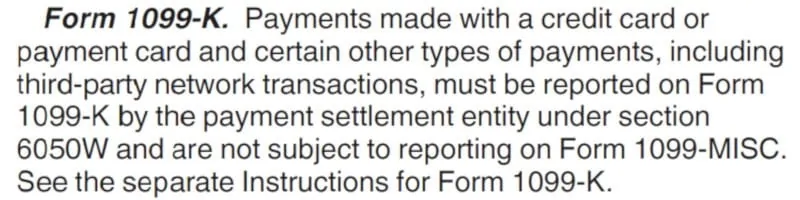

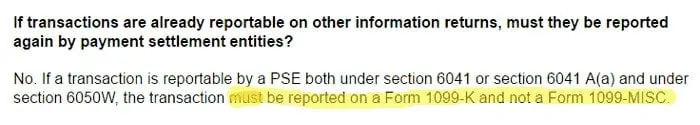

This pretty much means that if a business pays a contractor via non-cash methods, they DO NOT file a 1099-NEC for those people.

It doesn’t say “Well, you can do it on either and if you’ve been filing 1099-NEC forms all along then you don’t have to stop now”.

It says plain and clear “NOT SUBJECT TO REPORTING” which means DON’T DO IT.

Heck, if you go and look at the other side of the equations, this is what the 1099-K instructions say:

Again, any payments by a payment settlement entity (ie: PayPal) do not get reported on a Form 1099-NEC.

But, for one reason or another, many companies, their (hack) accountants, or the companies they use to run payroll (since this is really a payroll issue at heart) don’t care.

In the end, what can, and usually does, happen is the IRS cannot match your reported income with the figures reported on your behalf because of this double income reporting.

The part that makes this suck more is that the IRS generally is 2 years behind on doing its matching thing.

So, in essence, you may have to wait around for up to 24+ months to find out if you will even be receiving that dreaded envelope with the IRS logo on it.

What To Do When You Get An IRS Notice

Now this is where you are going to change your tune about the IRS (Maybe. Possibly. Probably not.)

When you get a notice stating that the income you reported on your tax return doesn’t match the records the IRS received under your tax id number do not panic!

This is an automated notice which is just stating facts, nothing more.

It isn’t an indictment.

It isn’t a levy.

It’s not even a threat.

No one’s coming knocking at your door and no one is sending you to collections or even jail. (You need to start learning how to be more discerning about what you believe on the internet!)

It’s basically a notification of the difference and a chance for you to explain what may have happened to cause this discrepancy.

There is nothing to worry about!

What you need to do is keep a level head so you can deal with the issue quickly and efficiently.

How do you do that?

Follow these simple steps:

- Gather your info

It’s important to have your shit together before taking any action. You want to be able to see exactly what caused the issue, and that means having all of your 1099-NEC forms handy so you can match one or more to the difference the IRS is looking for. It’s something you can do on your own with a little work. - Contact the IRS before the deadline

This will turn off the “follow-up notifications” where the threats and warnings start coming into play. All you need to do is call the number provided on the notice and say “I’m calling in response to the notice I received about my income not matching. What had happened was I was paid via a third-party payment service/merchant processing company and the company(ies) that paid me issued a 1099-NEC even though it wasn’t supposed to be filed. That is why my income looks to be lower on my tax return than what you have on file for me.” - Write everything down

It’s important to make sure you have a record of everyone you spoke to and when. I don’t care if you have to write it on the palm of your hand, but every time you speak to someone about anything regarding this situation make a note of it. Write down the IRS agent’s name and ID number. Notate the date and time of the call. Do the same for anyone you speak to at the company you are dealing with or their accountant/payroll processor. Being able to point to facts will help your case more than you can anticipate. - Do what the agent tells you

There are two things that can happen next. One is the agent will ask you about the specific 1099-NEC forms that were erroneously issued. If that/those do indeed equal the difference, then they may close it out right then and there. The other thing that may happen is you may be told to contact the company(ies) and request that file an amended 1099-NEC for you. - Call the IRS back if you don’t get a resolution

Sometimes, companies don’t want to spend the time and/or money fixing a problem they themselves have created unless it’s widespread or there is pressure coming from “above” to do so. If you were told to try and get an amended 1099-NEC done on your behalf and the company refused, you can get help from the IRS. You can call the same number from the notice, although it’s difficult to get to the same agent easily. Most of the time, there aren’t dedicated agents unless the situation is more serious so you may have to do a little explaining again, although there should be notes on your account for the new agent to get caught up with. Tell them that you tried to resolve the situation, giving them all of the information you wrote down during all of your interactions.

The IRS is only interested in factual numbers.

If you can show that your numbers are factual ones, then it shouldn’t be very hard to get things like this squared away more easily.

Just don’t freak out at the slightest sign of trouble or even the words Internal Revenue Service.

Two things will help you through this:

- Keeping your wits, and

- Following directions

If you approach this thing from a calm and logical place, you’ll make it through quicker and less stressed than if you didn’t!

Avoid Double Income Reporting From The Start

There is something that you can do to try to avoid this ordeal right away.

Rather than waiting to see if you’ll be put in this situation, you can be proactive.

Reach out to the companies you work with.

More specifically, find out who the person in charge of each company’s payroll department is–that’s the department that issues the 1099-NEC–or the person in charge if there isn’t a payroll department.

Let them know that since you are getting paid via PayPal (or via your merchant account) they DO NOT BELONG FILING A 1099-NEC on your behalf.

If they say that “we have to” for any reason, refer them to my article about when a 1099-NEC should be issued.

Then, offer to give them my information so they can get in touch with me and I’ll tell them exactly what they “have to do” and “don’t belong” doing.

If all else fails, you can always contact the IRS and file a complaint against any business which refuses to abide by the rules and purposefully goes against what the instructions clearly state.

Trust me, if they’re doing it to you, they’re doing it to plenty of others and they deserve to be reprimanded and fined for willfully screwing with you!

It sucks to be put in a situation like this.

I’ve already heard from several people who have and the good thing is, at least a few businesses have been willing to “consider” changing the way they operate in terms of issuing 1099-NEC forms to freelancers when they shouldn’t be doing so.

All you can do is report what you know to be accurate information and only pay your fair share.

Then let everything else unfold as it will and deal with it when it comes up.

At least you’ll be prepared in the event you do get that dreaded IRS notice!

1099-NEC and Identity Theft

Sometimes the 1099-NEC you receive isn’t incorrect due to the method of payment or the form of business you operate.

There is another instance that comes up quite often.

Tax fraud and identity theft.

It’s really easy to do, too.

All it takes is getting someone’s name and address.

An identity thief will create a fake 1099-NEC with a real company’s name and address, but with a false email or phone number in the sender section.

Then they mail it out to unsuspecting taxpayers who freak out when they receive it.

The taxpayer then calls the number and gives their full information to “verify” that it’s them, then…

BOOM!

You’ve just become a victim of identity theft.

One way of protecting yourself from this form of identity theft is to check the info on the form.

Is your social security number correct?

Is your legal name in the payee field or is it a “nickname”–a would-be identity thief could get that wrong which would be a clear sign of a scam?

Verify the email and the phone number that is listed in the sender section against public records or on the “company” website directly.

Also, be sure to read through my article on identity theft protection to be aware of other kinds of scams and schemes; I also cover many ways to keep your information secure.

Your Turn

Have you ever received a 1099-NEC when it wasn’t supposed to be sent to you? How did you react? What did you do to resolve the problem? Share your experiences so others know that it’s not just them and to give them hope that it can be rectified 🙂

Question, I received a 1099 MISC for a $600, non-employee compensation, from an elementary education foundation when I volunteered to produce their spring musical my daughter was in. The $600 was a stipend for the many hours spent producing the Musical.

I’m trying to submit my taxes however the Foundations Tax ID has too many numbers in it and I don’t have a number to contact anyone there. Also, to top it off, my SS# is not on the 1099 MISC, I wasn’t asked to fill out a W9 (I think it’s called). What do I do?? I don’t want to be penalized later but this is holding up me submitting for my refund??

Thoughts/Suggestions??

Hello Shelly!

You need to speak to the person at the foundation who handles/coordinates your volunteering. It doesn’t sound like they filed an actual 1099-MISC with the IRS if neither the EIN is correct no your SSN appears on the form. Ask them if they gave it to you just so you know to add it to your return or if they intended it to be officially filed.

If they don’t want to file a real return, you can just add the $600 on the tax return as “other income” however the software you are using requires without inputting it specifically as a 1099-MISC input. You may need to call the support department of the software if you don’t know how to do that.

I have been working for a company for 13 years with a courtesy title of COO, I receive a 1099 because the owner does not want to pay taxes. What are my rights?

Sorry Cameron, I can’t help you.

You need to speak to an employment attorney for that.

My husband received a 1099-R from a retirement plan with an old employer back in January. We never received or requested a distribution. Our address had also been changed to MA from MD and that is where the distribution was sent. Obviously fraudulent. Because of this we had to extend our tax return because I wasn’t sure what to do with the 1099. I didn’t want to report income I never received. Also, since it is saying the state tax was withheld in MA, I don’t want to have to file a MA state return. We live in MD. The 401k administrator, Principal Life Insurance Co., has been less than helpful in the situation. We have been waiting for weeks for the investigation to be completed. As of yesterday they were attempting to get the money back from the bank where the fraudulent checks were cashed. That can take another 6 weeks they said. I asked if they were going to issue a corrected 1099 and they said no and that the 1099s are issued in the year the money is withdrawn from the account. They have to issue a corrected 1099 for 2018, right? Even if it just to correct the state in which the tax was withheld? This cannot be the first time this has happened and I am very unhappy with the amount of information I have been able to get from the plan administrator. Any insight you could provide would be greatly appreciated!

Thanks in advance!

I received a 1099 from the attorney who represented me in the wrongful death of my son. The award was split between my son’s mother and myself (divorced from each other). the tax preparer informed me that the compensation from the insurance company is not taxable income. We included the income on the 1099 but then adjusted it on the schedule one line 21 to subtract it right back out. I received a notice from the IRS stating that they disallowed the write in on line 21 of schedule 1 (2018 1040). I have all of my supporting documentation that shows the funds we compensation form the law suite. The case was settled in mediation. The two checks issued to my attorney in my trust. After he took his fee and expenses he sent me a check for the remainder. So the question is this taxable and how do I rectify it if my supporting documentation does not meet the IRS burden of proof threshold. I am mailing response off today, very long wait time by phone.

Hello Jim.

I’m sorry for your loss and your subsequent issues. The wrongful death settlement is generally not taxable.

I don’t have all of the context and specifics regarding the actual return that was filed or the exact correspondence from the IRS so I couldn’t give you any advice as to why/why not but your preparer should be more than willing to do that for you.

This is definitely one of those situations where you want to stay away from the internet forums and online groups and stick strictly with a qualified professional to help sort this all out. Everyone and their mother will jump to give you advice to show off how “smart” they are but only true professionals will tell you that they need ALL OF THE INFORMTATION before even considering a response.

Best of luck!

My Ex sent me a 1099 suposely for a car that he bought me when we were togather 2 yrs after he bought it. He Is mad because I left him. I worked for that company for 6 yrs and he sold my vehichle through the Auction which he owned. That’s why he replaced my car. Is this legal. 15,000

Hello Shauna.

I’m not an attorney so I can’t speak to the legalities of what was done. I would talk to an attorney.

I received a 1099-Misc from Geico (Car insurance company) but I haven’t received any money or anything from them, no claims or wrecks or anything while using that car insurance.. why would they send me one for over $900? Also we received this a couple weeks after already filing our taxes for this year.. what does all this mean for me?

Hello Jake.

I honestly could not answer that question. What you should do is try to contact the company–there should be a phone number in the section for the issuer information of the 1099-MISC. See if you can verify that number is actually a GEICO number and not a scam to try to get your personal information for identity theft purposes. Or you can go to the GEICO website and get the general phone number and see if you can get to the department that way so you know it’s the legit company you are speaking to.

Hi! I drive for a ride share company and have done so for several years. In previous years I received a 1099 MISC (reporting incentives, loyalty and other miscellaneous payments) in Box 7, a 1099 K (reporting gross payments). The amount on the 1099 MISC was a few thousand dollars – the amount on the 1099 K was over $20,000. The “filer is a PSE” and “third party network” boxes are checked on the 1099 K this year and last year.

This year the amounts on the 1099 MISC and 1099 K I received in the mail match. Has something changed? I am 99.9% sure this is incorrect. Strangely, when I view the forms on line the amount on the 1099 MISC is different than the one I received in the mail. I have tried to reach out to the ride share company but their support is notoriously horrible and they don’t even seem to understand what I am talking about. How should I handle this? Can the IRS tell me what was reported to them? Any guidance you can provide is greatly appreciated.

UPDATE: I have been on the phone with the rideshare company most of the day and they are trying to tell me that the 1099s are NOT provided to the IRS. I know this is wrong.

Hey Lisa.

The IRS should be able to give you information regarding what was reported on your account. The 1099-K is usually send to drivers for driving services only. The 1099-MISC is normally for all other income payouts.

I would go to your online account and check out the support section for tax forms.

Thanks Eric! I tried to call the IRS today but hold times were horrible!Unfortunately, there is no support section with any usable information on the website. I’ll try the IRS again tomorrow. Thanks again for your help.

In 2018 I sold my sole proprietorship business. I am receiving 1099’s for 2019 from customers of the business I sold in 2018. We provided customers in 2018 new forms W-9 of the new owners info. What should I do?

Hello Gary.

Unfortunately, you will have to contact each of those customers and inform them that you are not the business owner any longer and they need to issue $0 1099-MISC corrections for you and then reissue the 1099-MISC in the name & social of the new owner.

If you cannot get them to comply, you can do as I mention and report it to the IRS. Just make sure you document all of your attempts to get it resolved on your own first.

Hi, I just received a 1099-MISC from uber saying I made $909.50 from them last year. Not only do I not drive for uber, I am permanently disabled and cannot even drive! I’m afraid this could mess with my disability benefits. I’ve tried to call uber but they only let you talk to anyone if you need help as a driver or a passenger. not sure what I should do.

Hello Lizzie.

The first thing I would do is check to make sure that your social is correct on the 1099-MISC.

Uber doesn’t send a 1099-MISC to drivers, but to people who get referrals and promotions so that may be why you got one. Otherwise, I would call back and just go to the driver side and see if there is anyone to whom they can refer you for this.

Thank you for the response Eric! my social was not correct, something I noticed after I posted my issue on here. spoke with the driver side folks at uber and thankfully all is well and I don’t have to worry about the irs thinking I made this money and didn’t report it. I really appreciate you taking the time to help me & wish you all the best!

It’s my pleasure, Lizzie!

Happy you got the issue resolved ?

I just received an email from a company saying I need to fill out an 1099-MISC. I never received any actual money from them, just online credit (which did exceed $600, but it was all online credit for their website). And I hadn’t heard about it before today, even though I believe the deadline for 1099-Misc is 01/31. I was wondering if this is something I should be getting a 1099-Misc for? I’ve never worked for the company before, and never done a 1099 before so I’m unsure how this works.

Hello Tori.

I’m assuming you meant that they are asking you for a W-9 so they can send you a 1099-MISC.

The 1099-MISC isn’t just for “monetary compensation”–it’s for any kind of payment that is in excess of $600 for people who are not employees. People who win on game shows get them, as do radio call-in contest winners. They report the value of the winnings since it’s all considered “income”.

That being said, it’s not out of the question for you to need to receive a 1099-MISC for the referral credit you got.

The company I work for receives 1099 MISC every year and most of them are not ours, they do not list our tax ID and company name. Should I return these to sender or what should I do?

You can certainly contact the sender and let them know that the information is incorrect. At the very least you can feel good about doing a good deed and letting them know of the mixup.

I just received a 1099 from a company that I did NOT do over $600 worth of work for, they are claiming I did. Because I knew we wouldn’t do over $600 worth of work I never filled out a W-9, and they never asked. I go by my middle name for anything that doesn’t require my legal name “like bank accounts and taxes”, so all they had was my middle name. So they got on facebook or something and found my last name, then I’m guessing googled it and found a address I lived at 4 years ago. Because I know the person who lives there now they dropped it off to me. And they put my social as 999-99-999. So they do not have my legal name, the current address that I have been filing taxes from for the last 4 years, or my social. First question, whats stopping me from throwing this away? Literally if I didn’t know the person living at my old house I would of never gotten this. And without any matching information how would the IRS tie this back to me? Second question, they paid me $500 via check. They are claiming they paid me $1,000. I only did one job, for $500. What do I do?

Hey John.

I would not address this situation at all since your social isn’t on the form 1099-MISC and it isn’t being reported under your tax ID.

If you want you can call the company and ask them exactly what they are trying to accomplish by sending a 1099-MISC with a false social on it rather than simply asking you for a W-9, and address why they are saying you were paid an incorrect amount you are well within your rights.

In reality, it may be more stressful and a bigger time suck to try that than to just let it go.

Hello, I received a 1099-Misc from a company who processed payments like PayPal? I did not work for them, however they lumped all payments that were made to me through their website? I did not exceed the $600 for “any” of these companies I worked for. I request a correction and they said NO! I inquired at IRS and they indicated a 1099k if applicable. I do not even meet that criteria?

Hello DonnaKay.

Your comment is a bit confusing.

You didn’t work for the company yet you got paid for doing work for them? I’m not exactly sure what your situation is.

That is correct. I did work for a company off the web and was paid direct deposit through a portal like PayPal and they sent a 1099 misc. I told them that I did not meet federal requirements of $600 or exceed 20 payments or over $20,000 for a 1099k but they refuse to correct it? I called the IRS to confirm and was told to file a complaint. I did not want to go that route but I do not believe I will have a choice, I already filed my taxes. 🙁

All I can tell you is that if you honestly believe that a company is being purposefully difficult in not following the rules and refusing to comply, then you should follow the IRS directive and file a complaint.

Other than that, the only thing you can do if you filed your taxes reporting all of the income you earned is to let it go and move forward with your life.

My husband received a 1099 k from Stripe over 3200.00 he’s been a fraud victim in the past and apparently someone is using his Social and name again. This time they are using Stripe to sell digital goods. Stripe has been notified and they are looking into it but they have sent 1099k into IRS so what do we do?

Hi Leslie!

The IRS has an identity theft unit which you can contact: https://www.irs.gov/newsroom/taxpayer-guide-to-identity-theft#1

You would need to let them know what is going on and inform them that Stripe is aware of the situation and is looking into it, but you should absolutely get an ID Theft PIN for tax return filing.

Also, if you are looking for some ways to protect your husband’s info I have an article written about identity theft protection which may contain steps you weren’t aware of.

Hopefully, it all works out for you!

I’m dealing with Stripe too. Good luck.

I need help. I received a 1099k from a company named Stripe.inc there is no phone number for the company, just an email address in the company’s address and they only take outbound calls no inbound calls. when I spoke to someone named Vicky she refused to give me any information on the account number that was on the 1099 the date the company was supposedly started up under my namefor information on this and it just showed two months of transactions from a third-party Network totaling $32,000. Being that I have the account number on this supposed 1099-k they won’t give me any information on when this company was opened or whatsoever and I’ve already filed my taxes. What do I do. There is no way to contact a manager of stripe Inc.

Hi Monica.

First I would suggest that you check the information on the 1099-K to make sure it is yours. If it isn’t it’s clearly a scam and you can read my article about identity theft protection because this is one of the topics I address.

If your information is correct, I would use this form to contact Stripe: https://support.stripe.com/contact/email

The company indeed states on its site (https://support.stripe.com/questions/contact-stripe-support) that there is no inbound call capability and that you can only schedule a callback–if you are an account holder. That part is legitimate.

Hopefully, you get this resolved to your satisfaction!

The only information on there is my name and address. The part for my social looks like this ***-**1234 and it only shows the last 4 of my social. When a spoke with Vikki from stripe, she was no help, all she told me was to contact my local police department and the FTC to file a report and then they would look into the matter. I don’t know what else to do and I already filled my taxes. I even asked Vikki went hasn’t stripe sent out monthly statements and I guess that question caught her off guard because she had no answer. Then when I asked for information on the account since it’s on the 1099k form, she refused to give me any information.

There’s really not much else I can tell you Monica…I’m not associated with Stripe in any way.

Perhaps using Twitter to get in touch with someone who can possibly direct you to someone who can better handle your situation

Hi Eric,

I received a 1099 from a Reliance Trust Company in Atlanta of which I’ve never heard. Seems like a Ghost company because you can’t get a hold of anyone on the phone, it’s just a automated loop of extensions with no one on the other end so it appears to be a variation of identity theft. My name and last four (the only exposed digits) of my social are correct as well as my previous address from which I just moved. How do I make sure the “contributed” amount and taxes get nullified?

Hey Harley!

I would look up the company and see if there’s a different number to call that might give you more information. A lot of times, people forget that they had interactions with companies, especially when it comes to subsidiaries and name changes.,

If not, you can always call the IRS and let them know you have no idea what this company is and that you cannot reach anyone to fix this issue.

I have a S corporate construction company and received a 1099 MISC from a client. I have informed their accountant our S corporation status with an updated W9, I also mentioned per 1099 MISC instruction, S corporate does not need to receive a 1099 Misc. However, they refused to correct 1099 Misc. They replied “we chose to issue the 1099 to be on the safe side for our client. It’s not forbidden, not illegal.” I am not sure how to convince their accountant to correct the 1099 Misc. To my knowledge, there is no specific spot on 1020S to enter 1099 Misc form with payer’s information. Would this cause IRS alert if only income is included on the return but this payer’s information is not showing on my 1020S? (Basically IRS doesn’t have the information from our 1020s return to match this payer record).

Hello Yanti.

Honestly, if they refuse to comply with IRS instructions then let them waste their money. That’s really all it is at that point, and you most likely have better things to do with your time.

The double income reporting is only an issue for sole proprietors or single-member LLCs taxed as sole props, so I would just move on with life.

Hey,

So last week I received a 1099k form filed by a company named Dwolla Inc located out of Iowa. The form states that I received payment in the amount of $4,000 dollars which I never received or no anything about. The merchant copy number is only one number (0). I attempted to contact this Dwolla company and have yet to hear back. So now I have to claim this $4000 dollars that I never received or have no knowledge of. Not sure if it’s a scam because my SSN is on the document. Your advise on what to do would greatly be appreciated.

Thanks

Hello Brian.

Dwolla is a service that processes payments, similar to PayPal. It is certainly a legit company, but if you never used it to receive payments from anyone you may want to contact them at [email protected] if you cannot get through to anyone.

Here is the link to the page on its site related to Form 1099-K: https://www.dwolla.com/form-1099-k/

Today was the day. I was almost through filling my taxes out online when I realized I had one more form left. It is a 1099-MISC from CMG Corporate Services Inc. out of GA. I have no idea why I received this as I am in MA and when I call the number, it goes to a voicemail of a woman stating her name and nothing about the company. It says on the form the “other income” is $750. Am I being scammed here??

Please help!

Thanks,

Joe

Hey Joe!

I can’t say for sure if you are being scammed. If your information is correct, you may just not recognize the company as many businesses operate under a name other than the legal one which is what’s required on a 1099-MISC.

What’s more, if the money is under “Other Income” then it could be for prizes won such as in a website or radio call-in contest. The reason that’s important is that winnings of such awards is considered taxable income.

The best thing is to try to get in touch with that person or try to figure out if you made money via a contest or other means that would trigger a 1099-MISC to be issued to you.

Good day Eric, i worked for a private christian school for four years as a bus driver, teacher and coach. In 2018 they sent me a 1099 for driving the bus. I do not own the bus the school does. No other year did i receive a 1099 and neither had the other drivers. When i asked about it it was swept under the rug. What is the proper procedure in reporting the school and this issue to IRS?

Hey David.

It sounds like the school should have given you a W-2 rather than a 1099-MISC since a school bus route is not something that you have control over ie: you have to make pickups starting at a specific time and stop at predetermined locations.

The proper way to to get it resolved is to do exactly what I outlined in the article–calling the school and explaining the situation, notating all of your efforts with specific details like names and dates/times, then calling the IRS to inform them of your failed good-faith efforts.

Good luck!

Enjoyed your article and definitely will continue to follow. 🙂

I do a side hustle and file a schedule C each year.

I did some free work for a friend who opened a business. I invoiced her for reimbursement expenses which she paid.

The new accountant sent me a 1099-MISC for all of the reimbursed expenses. I asked him to correct it, he did and I received a 1099-MISC with an X by “Corrected” at the top.

My question, is do I report the corrected 1099-MISC? Or do I simply keep it for my records and carry on?

Hello Donna.

You have to report what is showing on the corrected 1099-MISC because that was reported to the IRS.

I received a 1099 in the mail, although i did not know I was working for a 1099 company, we had to report to the same building everyday, we had a dress code, they provided all the equipment we needed, always worked in the same building. Now I am told I owe those taxes and the taxes the should have paid on me. I thought this was not considered a 1099 job. Is there a form to fill out to dispute this with the IRS?

Unfortunately, there isn’t a form to dispute that Jennifer.

What you can do is address it with the company now and get it straightened out. I’m assuming you didn’t get a W-4 to fill out for your withholding or paystubs with a breakdown of your pay and tax deductions/withholding for each period–those are red flags that would signify that this is not a W-2 job. Other than that, the exact compensation practices should have been laid out for you before you even accepted the offer.

There really isn’t much recourse unless you can possibly file a complaint with the US Department of Labor or your state’s labor board. I’m not an expert in that area so you’d have to do some research.

I received a a 1009-NEC from Varadero Masters Fund LP C/O Walkers Corporate Services LTD and i cannot find any information on who the are. I never received any money from them.

Has anyone else received a 1099-NEC from them?

Hello Ron.

Does the 1099-NEC not have a phone number listed in the Payer filed? If not, this is the website for Varadero Capital, the company that maintains the fund you received the 1099-NEC from: https://www.varaderocapital.com/

It’s based in NYC where Walkers Corporate Services Ltd seems to be based in Bermuda and has no offices in the US.

Thank you for taking the time to answer our questions! I have received a 1099-NEC from an LLC that has been refusing to send me my pay for 2020 (legal action pending). I have not received any compensation for services rendered for the LLC in 2020, but they have reported that I have been paid the full amount owned for 2020 to the IRS. How does one go about reporting this to the IRS?

The best thing you can do is to call the IRS and present your situation and let them tell you how to approach it.

Other than that speak to your attorney.

I received incorrect IRS Form 1099. My property manager won’t issue me a corrected 1099 inspite of repeated e mails and phone call. What is my recourse.

Hello Carlos.

I’m sorry that you are going through this. The simple answer is to go through the steps I outlined in the post–making sure to take notes and detail all of the names, dates and times to show that you are being thorough.