You Need An Emergency Fund Now More Than Ever

This post may have affiliate links. Please read the Disclosure Policy for complete details.

There has been some talk for a while now about how important it is–or isn’t– to have an emergency fund.

So much so, that some people have actually begun to dismiss the notion.

They say it’s a waste of investable assets or some other nonsense.

There is some validity–to some tiny degree–to that way of thinking.

If you are keeping that money in a regular checking or savings account at your local bank that pays almost 0% in interest I would agree it’s a waste.

There are, however, plenty of financial institutions that pay 1.5% or more so those emergency savings will actually work for you.

But that’s a discussion for another day…

The big thing is that the emergency fund is important when it comes to managing money.

It has been, and will always be, an important tool to have in your financial toolbox, especially in a complete emergency preparedness plan.

If you’re not very familiar with the concept, you’re in the right place!

Let’s start at the very beginning with…

What Is An Emergency Fund?

Generally speaking, an emergency fund is simply a separate bank account holding money designated for “emergencies”.

It enables you to keep money earmarked specifically for emergencies separate from any other money so it’s always there when you need it.

What you consider an emergency, however, can differ from the next person.

Some of the more common examples include:

- Job Loss

- Car repairs

- Medical issues

- Casualty losses

- Necessary home repairs* (ie: air conditioner, water heater, roof)

- Pet emergencies

*My definition of necessary home repairs aren’t upgrades or additions just because you want to increase the value or want a change–they are required to be able to live in the home.

Where Should I Keep Emergency Fund Money?

This is really up to you.

You can keep your money in a variety of accounts/vehicles:

- Checking

- Savings

- CD ladder

- Cash

- Credit Card

- Home equity line of credit

Some people might scoff at using credit cards as a way of paying for emergencies, but if you are responsible with credit–and pay off credit cards on time–I personally see no reason why you can’t.

You may be wondering why I don’t any kind of investments listed above, and that reason is simple:

I don’t believe that emergency funds should be subjected to the uncertainty of the markets.

Principal preservation should be the main concern, not growth in this specific instance.

That’s why almost everything I mentioned are bank products that are insured.

Of course, there’s cash on that list as well which isn’t secure by any means.

But, I also think it’s important to keep a “cash stash” close by in case of times when access to a bank or the ability to process a credit card isn’t possible such as when natural disasters cause widespread power outages.

Not that your emergency fund should consist entirely of cash, but enough to get you through a few days in case the above circumstance happens.

How Much Should I Save In An Emergency Fund?

This is a point of contention among “experts”.

Some people will say “get to $1,000” to start.

Others will say as little as 3 months’ worth of expenses.

Still, others will go as high as an entire year’s worth of living expenses:

Stefanie O’Connell Rodriguez–a personal finance speaker, and author–lays it out perfectly in her tweet.

She doesn’t aim for a specific dollar milestone such as $10k or $20k.

Instead, she is focused on covering her actual living expenses for a year in her emergency fund.

Unfortunately, that requires actually knowing what it costs you to live–also known as budgeting money–which is a major sore spot for many people.

What Expenses Should Be Covered By An Emergency Fund?

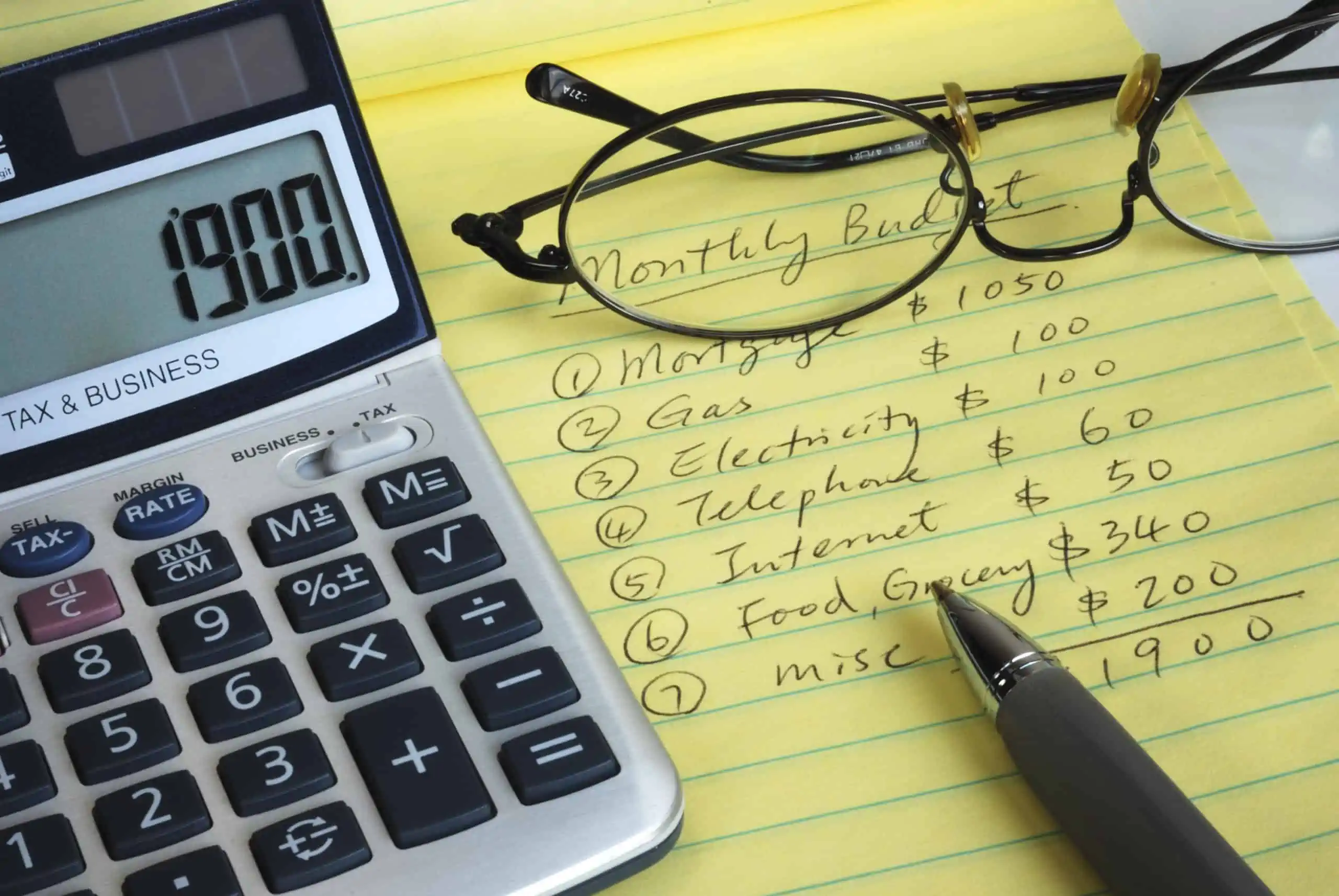

As I just mentioned, you need to learn to budget.

In its simplest form, a budget is just a list of where your money comes from and goes.

Without getting too crazy, you can simply start with a spreadsheet and make a column listing all of your income and expenses (separating the two groups, of course!).

I recommend concentrating on regularly occurring living expenses.

Of course, some of these expenses may not apply to you depending on whether you rent vs. buy your residence.

Expenditures such as:

- Rent or mortgage payment

- Health insurance

- Homeowner’s or renter’s insurance

- Utility bills (gas, electric, water, sewer, garbage, cable television, internet, cell)

- Maintenance & upkeep (lawn care, exterminator)

- Car payment, rideshare, or public transit costs

- Child care and schooling

- Grocery delivery service

- Medical costs & prescriptions

In the next few columns, list out the past 3-4 months’ amounts in those categories to get a baseline for your average monthly living expenses (or use whatever time frame you prefer).

Then, go through your records to see what “discretionary” spending you had, such as entertainment and miscellaneous spending.

I put “discretionary” because everyone will put consider it to mean different things.

Take your average for whatever time frame you use and multiply that by the number of months’ worth of savings you want in your emergency fund and that’s your target.

Now you just need to start saving!

How Can I Save Money For Emergencies?

Ah, the million-dollar question:

How do I save money?

You have a lot of options to come up with the cash for your emergency fund.

Here are but a few routes you can take to build up your emergency fund:

- The Change Jar–every time you spend money, pay with just bills. Every time you come home, empty your pockets of the change into the jar, and when it’s full, bring it to the bank to deposit into your emergency fund account.

- Automate Your Savings–Set up an automatic transfer from your main bank account to the emergency fund account on specific dates–the last day of the month, each payday, it doesn’t matter as long as done automatically and regularly.

- Transfer “Savings”–Every time you use a coupon or get a receipt with a “you saved” section, take those “savings” and transfer them to your emergency fund. You can read more about this method in my Lifehacker profile.

- Overtime Pay–Each time you work overtime (if you have a job that pays it) take the difference between that and your regular take-home and immediately move that to your emergency fund. You’ll never miss it if you don’t see it!

- Bonuses–treat them just like overtime. If you get a separate bonus paycheck, simply transfer the entire thing.

- Raises–If you get a raise, instead of allowing lifestyle creep to take hold, increase your emergency fund savings instead!

- Side Business–You can always start a small business on the side of your regular job (assuming you have a job and aren’t already self-employed) if you have the time and mental bandwidth. Instead of using the profits from the business to buy stuff, you can transfer that net income into your emergency fund to help build it faster.

- Selling “Stuff”–You can go through your closets or garage and set stuff aside that you don’t want or use to sell. you can have a garage sale, or even sell on eBay, taking the profits to fund your emergency fund.

- Tax Refund–If you happen to receive a tax refund, you can have it direct deposited into any account you want, not just your main checking account. You simply direct the IRS (and even state if you get a refund) to deposit at the financial institution of your choice–all software allows you to customize the amounts and even split it up between multiple accounts.

- Rebates & credit card statement credits–for example, the money you get back from using a shopping portal like Rakuten and the credits you get by using certain credit cards which give you statement credits for shopping at certain retailers.

You may find one of these methods to be a good fit for you.

You may find that 2 or 5 of them are things you can incorporate into your savings plan.

The important thing is to find out what works for you–not what others are doing–and implement it (them).

Emergency Funds Aren’t “Set & Forget”

Your life is ever-changing.

During your lifetime you may:

- Get married

- Get divorced

- Have a baby

- Move within your state

- Move to a new state

- Lose a job

- Get another job

- Retire

- And a variety of other events

All of those things will change your financial situation.

When your financial situation changes, you need to adjust your plans.

That includes your emergency savings.

If something happens and your living expenses increase, you need to adjust your target for emergency savings upwards.

If circumstances cause your living expenses to go down, then you will want to adjust your emergency savings target lower–that can mean taking some money out of the emergency fund and moving it to investments.

The point is that life is fluid so your financial plans need to be as well.

Saving Anything Is Better Than Having No Savings

Yes, the days of double-digit interest rates on savings accounts are probably gone forever.

Gone, too, are the late 90’s and early 2000s when you could earn up to 7% interest.

Today, we’re dealing with historically low-interest rates.

So what are savers to do, particularly when it comes to emergency savings?

Stuff their cash in coffee cans and bury them in the backyard?

Keep cash hordes in a shoebox in the closet?

Regardless of the interest rate, you may be getting on your savings anything is better than zero as a rate of return.

Obviously, with interest rates as low as they are, the temptation is there to talk yourself out of keeping your money in a liquid, easily accessible cash account.

The inclination may be to keep just enough money in a checking account and opt for other vehicles such as investment accounts, peer-to-peer lending accounts, or even to use the cash to pay off bills since the return will be greater compared to parking the remainder of your money in a non- or low-interest paying account.

The fact of the matter is that no financial plan is complete without liquid accounts that are easy to access at any given moment.

But, why is it so important to put the money in an account that earns such a paltry return?

Why shouldn’t I just keep the money in a sock in the back of my closet since I can access that at any time I may need it?

The answer is very simple, and it’s the same reason you should never opt out of an employer-matched retirement account: free money.

Since you need to have a liquid account, whatever the reason, it makes absolutely no sense in the world to have the money just sitting there.

If you are going to have money in a deposit account, you might as well have that money working for you, making the most of each dime you can.

The best thing you can do for yourself is to ensure that you are getting the most out of every dollar you have.

So what if you aren’t going to get rich from a savings account, at least you will be getting something in return, even if it means having a little extra in the event of an emergency.

That is the exact purpose of having emergency savings anyway!

Wrapping Up

So…

If you weren’t familiar with the emergency fund before hopefully, you have a much better understanding of the concept now.

And hopefully, you understand just how important it is to have a complete financial plan it is.

Never mind what may be happening in the world at this very moment, the emergency fund will help keep you solvent and financially stable through most negative events!

Your Turn

Do you have an emergency fund–why or why not? If you have, has it ever saved your butt in a tight spot before and would you recommend everyone strive to have one?