What To Do When You Wrongly Receive A 1099-NEC

This post may have affiliate links. Please read the Disclosure Policy for complete details.

This is a follow-up to my previous article about sending Form 1099-NEC when they aren’t required and how it can be costing you money and give your partners unnecessary work. This is the flip-side for those of you who are the ones on the receiving end.

Also, for reference, a new old form is coming in 2020 called the 1099-NEC. For all intents and purposes, this is the form for paying independent contractors and freelancers going forward. The rules for the 1099-NEC are the same as for the 1099-MISC and the IRS still uses the “MISC” in many of its instructions.

One second you’re walking to the mailbox, not a care in the world.

The next second, you’re filled with dread.

You hold a letter from the IRS, your hand trembling.

Scared as you may be, you open it, hoping it’s not what you think.

Experienced freelancers will know some of this already.

If you are relatively new to freelancing, this may be totally new.

In either case, you’ll want to pay attention.

Why?

I can guarantee that if you haven’t personally, you know someone who has dealt with it.

And because I’m going to put your mind at ease about it.

So what is “it” already?

DOUBLE INCOME REPORTING.

And it can be a pain in the ass, not to mention scary as shit if you aren’t prepared.

Tax Forms You Need To Know About

I like to be thorough and not take anyone’s level of knowledge for granted, so bear with me for a second while I explain this to anyone who isn’t very familiar with the concept.

Hell, you self-taught experts may surprise yourselves with how much you didn’t know so you may want to read this all the way through too!

As a business owner/contractor, you aren’t treated the same as an employee.

You don’t get a regular paycheck with taxes taken out.

You don’t get a neat little W-2 at the beginning of the year summarizing your earnings and tax withholding in a single, neat document.

Instead, you are responsible for calculating and paying your own estimated taxes, getting a form 1099-NEC instead (if you earn $600 or more from any single partner for the year and paid via cash, check, bank transfer, or money-sharing app).

This can be loosely described as the non-employee version of a W-2, except it only shows income (no tax info since you do that independently of the people you work for).

You probably don’t even get a check or direct deposit at all.

Most likely you accept credit cards in your business.

Or get paid via a 3rd party payment processor such as PayPal.

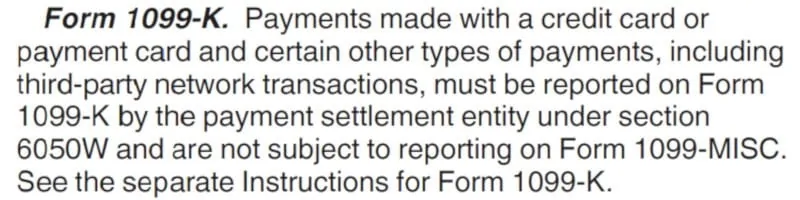

In that case, you may get a Form 1099-K.

This form is quite different than the other two which were mentioned earlier.

A 1099-K is a form that payment processors send out to people who reach certain minimums in terms of transaction volume and the total value of receipts (200 transactions and $20,000).

So that’s a basic overview of the differences between all of the tax forms which you need to know about.

How Double Income Reporting Occurs

This is where things appear to get complicated, even though they aren’t, and shouldn’t.

And it’s not your fault whatsoever!

Every employer is required to send a copy of the W-2 to the IRS to match up with their income tax return.

It’s how the IRS knows that people (for the most part) are reporting what they earned and can’t cheat (although they always find a way).

The same thing happens any time a business or individual pays a non-employee more than $600…they send in a 1099-NEC to the IRS.

And if you qualify for a 1099-K–having in excess of 200 transactions AND more than $20k in gross billings running through a third-party payment processor like PayPal, Stripe, etc–a copy of that also goes to the IRS on your behalf.

But…wait just a second.

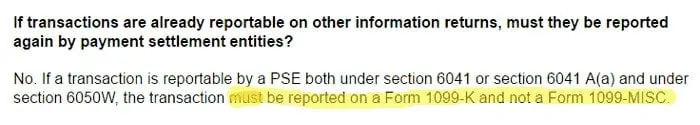

If you get both a 1099-NEC and a 1099-K, doesn’t that mean much more money is being reported than is actually being earned?

Ding ding ding ding!

That’s where you’re getting screwed over in a sense.

And why is that?

Here are the reasons for that:

This pretty much means that if a business pays a contractor via non-cash methods, they DO NOT file a 1099-NEC for those people.

It doesn’t say “Well, you can do it on either and if you’ve been filing 1099-NEC forms all along then you don’t have to stop now”.

It says plain and clear “NOT SUBJECT TO REPORTING” which means DON’T DO IT.

Heck, if you go and look at the other side of the equations, this is what the 1099-K instructions say:

Again, any payments by a payment settlement entity (ie: PayPal) do not get reported on a Form 1099-NEC.

But, for one reason or another, many companies, their (hack) accountants, or the companies they use to run payroll (since this is really a payroll issue at heart) don’t care.

In the end, what can, and usually does, happen is the IRS cannot match your reported income with the figures reported on your behalf because of this double income reporting.

The part that makes this suck more is that the IRS generally is 2 years behind on doing its matching thing.

So, in essence, you may have to wait around for up to 24+ months to find out if you will even be receiving that dreaded envelope with the IRS logo on it.

What To Do When You Get An IRS Notice

Now this is where you are going to change your tune about the IRS (Maybe. Possibly. Probably not.)

When you get a notice stating that the income you reported on your tax return doesn’t match the records the IRS received under your tax id number do not panic!

This is an automated notice which is just stating facts, nothing more.

It isn’t an indictment.

It isn’t a levy.

It’s not even a threat.

No one’s coming knocking at your door and no one is sending you to collections or even jail. (You need to start learning how to be more discerning about what you believe on the internet!)

It’s basically a notification of the difference and a chance for you to explain what may have happened to cause this discrepancy.

There is nothing to worry about!

What you need to do is keep a level head so you can deal with the issue quickly and efficiently.

How do you do that?

Follow these simple steps:

- Gather your info

It’s important to have your shit together before taking any action. You want to be able to see exactly what caused the issue, and that means having all of your 1099-NEC forms handy so you can match one or more to the difference the IRS is looking for. It’s something you can do on your own with a little work. - Contact the IRS before the deadline

This will turn off the “follow-up notifications” where the threats and warnings start coming into play. All you need to do is call the number provided on the notice and say “I’m calling in response to the notice I received about my income not matching. What had happened was I was paid via a third-party payment service/merchant processing company and the company(ies) that paid me issued a 1099-NEC even though it wasn’t supposed to be filed. That is why my income looks to be lower on my tax return than what you have on file for me.” - Write everything down

It’s important to make sure you have a record of everyone you spoke to and when. I don’t care if you have to write it on the palm of your hand, but every time you speak to someone about anything regarding this situation make a note of it. Write down the IRS agent’s name and ID number. Notate the date and time of the call. Do the same for anyone you speak to at the company you are dealing with or their accountant/payroll processor. Being able to point to facts will help your case more than you can anticipate. - Do what the agent tells you

There are two things that can happen next. One is the agent will ask you about the specific 1099-NEC forms that were erroneously issued. If that/those do indeed equal the difference, then they may close it out right then and there. The other thing that may happen is you may be told to contact the company(ies) and request that file an amended 1099-NEC for you. - Call the IRS back if you don’t get a resolution

Sometimes, companies don’t want to spend the time and/or money fixing a problem they themselves have created unless it’s widespread or there is pressure coming from “above” to do so. If you were told to try and get an amended 1099-NEC done on your behalf and the company refused, you can get help from the IRS. You can call the same number from the notice, although it’s difficult to get to the same agent easily. Most of the time, there aren’t dedicated agents unless the situation is more serious so you may have to do a little explaining again, although there should be notes on your account for the new agent to get caught up with. Tell them that you tried to resolve the situation, giving them all of the information you wrote down during all of your interactions.

The IRS is only interested in factual numbers.

If you can show that your numbers are factual ones, then it shouldn’t be very hard to get things like this squared away more easily.

Just don’t freak out at the slightest sign of trouble or even the words Internal Revenue Service.

Two things will help you through this:

- Keeping your wits, and

- Following directions

If you approach this thing from a calm and logical place, you’ll make it through quicker and less stressed than if you didn’t!

Avoid Double Income Reporting From The Start

There is something that you can do to try to avoid this ordeal right away.

Rather than waiting to see if you’ll be put in this situation, you can be proactive.

Reach out to the companies you work with.

More specifically, find out who the person in charge of each company’s payroll department is–that’s the department that issues the 1099-NEC–or the person in charge if there isn’t a payroll department.

Let them know that since you are getting paid via PayPal (or via your merchant account) they DO NOT BELONG FILING A 1099-NEC on your behalf.

If they say that “we have to” for any reason, refer them to my article about when a 1099-NEC should be issued.

Then, offer to give them my information so they can get in touch with me and I’ll tell them exactly what they “have to do” and “don’t belong” doing.

If all else fails, you can always contact the IRS and file a complaint against any business which refuses to abide by the rules and purposefully goes against what the instructions clearly state.

Trust me, if they’re doing it to you, they’re doing it to plenty of others and they deserve to be reprimanded and fined for willfully screwing with you!

It sucks to be put in a situation like this.

I’ve already heard from several people who have and the good thing is, at least a few businesses have been willing to “consider” changing the way they operate in terms of issuing 1099-NEC forms to freelancers when they shouldn’t be doing so.

All you can do is report what you know to be accurate information and only pay your fair share.

Then let everything else unfold as it will and deal with it when it comes up.

At least you’ll be prepared in the event you do get that dreaded IRS notice!

1099-NEC and Identity Theft

Sometimes the 1099-NEC you receive isn’t incorrect due to the method of payment or the form of business you operate.

There is another instance that comes up quite often.

Tax fraud and identity theft.

It’s really easy to do, too.

All it takes is getting someone’s name and address.

An identity thief will create a fake 1099-NEC with a real company’s name and address, but with a false email or phone number in the sender section.

Then they mail it out to unsuspecting taxpayers who freak out when they receive it.

The taxpayer then calls the number and gives their full information to “verify” that it’s them, then…

BOOM!

You’ve just become a victim of identity theft.

One way of protecting yourself from this form of identity theft is to check the info on the form.

Is your social security number correct?

Is your legal name in the payee field or is it a “nickname”–a would-be identity thief could get that wrong which would be a clear sign of a scam?

Verify the email and the phone number that is listed in the sender section against public records or on the “company” website directly.

Also, be sure to read through my article on identity theft protection to be aware of other kinds of scams and schemes; I also cover many ways to keep your information secure.

Your Turn

Have you ever received a 1099-NEC when it wasn’t supposed to be sent to you? How did you react? What did you do to resolve the problem? Share your experiences so others know that it’s not just them and to give them hope that it can be rectified 🙂

I received received 1099’a for 2012-2015 that was filed against me from my ex-fiance who we were in business together and never made any money from. I’m assuming he’s making up for fraudulent deductions he made when we were together and now putting them on me, as income he paid me… which he never did. What do I do? He has already filed these with the IRS, and of course I never filed for this money he is saying I was paid.

Hello Jean, thanks for reading and I’m sorry for your situation.

The first question would be: did you just receive all of these prior year forms all at once this year? If you did, you an certainly call the IRS and explain to the agent what you said about fraudulent transactions. The fact that the 1099s were never filed in the years they were “due” should give you a pretty good defense against them.

The best thing is to always contact the IRS first and explain the situation. They will then let you know if there is anything you can do to dispute it on your own.

If not, you may need to engage a tax attorney to deal with the situation. I specifically suggest an attorney because they are knowledgeable in the law, not just filing/preparing tax returns.

Thank you for all the information. I’ve learned a lot from reading your articles.

I get nervous when client asks me to fill out W-9 forms… I want to prevent the headaches of explaining to the IRS.

Is there a way to report (either or both the preparer and issuer of) 1099-MISC that shouldn’t have been prepared / issued?

Thanks for reading Susan!

If you do get a 1099-MISC when you weren’t supposed to you should contact the company that sent it to you. Explain the reason why you shouldn’t get it and you can even link to my article on why from the intro up at the top.

If they refuse and insist on leaving things as they are, you can always contact the IRS and make a complaint. Just make sure to give the company a chance to fix things because the IRS agent will undoubtedly ask if you tried to first resolve this on your own. And don’t forget to keep detailed records!

I received a 1099-k for 738. Should I be filing as business income and can I claim expenses against it. If so about how much expense can I claim. Or can I just not file the 1099-k?

Hey there Bianca!

If you received a 1099-K that means you received payments from a 3rd party processing company like PayPal or a credit card company. Essentially that’s going to be treated as self-employment income so you definitely report that as business income and therefore can deduct the costs associated with earning that money!

You’re not going to actually file the 1099-K, just use that to report the income you received. Also, make sure to report all of your income regardless of whether you received a tax form or not. Just because you didn’t get a paper stating so, doesn’t mean you can leave that income off of your tax return. **Every penny of income is taxable**

My husband worked for a barber shop last year and was issued a 1099-misc. He took credit card sales through his own business account and therefore received a 1099-k for the credit card sales. The barber shop reported the credit card amounts plus the cash amounts on the 1099-misc hence the double income issue. So if I’m reading this right…do we file both 1099 forms but subtract the 1099k amount from the 1099-misc and enter the difference for the 1099-misc instead of the full amount?

Thanks for the question Kristin!

The basic thing to remember is to not rely on the tax forms when doing your returns. You should always be tracking everything yourself and use those figures. What that means is you will be reporting ALL of the income your husband received for his services from his own tracking (plus you’ll claim the expenses that are legitimately deductible).

Then, if the IRS asks about the difference you can explain that the barbershop gave him a 1099-MISC for the amounts that were also reported by the credit card company and supply the documents. Or, you can contact the barbershop and have the person in charge correct it and issue one for only the amounts that the shop gave directly to your husband which should eliminate the worry altogether.

My daughter received a 1099 form stating that she made $9,000 last year. The problem is that she never worked for the employer that sent her the 1099. What should she do?

Well, Anonymous, the first thing that should be done is to check the name of the company sending the form because a lot of companies don’t operate under their legal name. Many have a corporate name which owns everything and then a DBA or “public name” that they use as the consumer-facing brand. Perhaps your daughter just didn’t recognize the name on the form.

If not, the next step is to try to find the phone number for the company sending your daughter that form and ask them why it was sent and where they got her info. Then ask them to file a $0 corrected 1099 if it truly was in error.

I just received a 1099-Misc I called the company asking what this was regarding and why was I receiving this form. When someone answered the phone they answered in Korean and they took my name and phone number and told me they would look into it and call me back. No one has called back. Isn’t Recipient’s TIN supposed to be your SSN? If so, this form did not have my correct information. How do I find out if this is a scam? What should I do?

Hi Ashley!

Was this a company for which you had any kind of relationship? It’s important to remember that not every company’s public-facing name is the same as the corporate name so you may not recognize it right off the bat.

If you didn’t expect to receive a 1099-MISC at all, and they have incorrect information I would try again to contact the company just to see where they got your info from. Don’t give them your social as they should never ask for that if it is legit. if they do ask for it, then you can be sure it’s a scam.

I would call the IRS and file a complaint if it is definitely not a company you have dealt with at all. If they did this to you there’s a strong chance they tries it with others as well.

My girlfriend received a letter from IRS, stating that her 2016 tax return doesn’t match the information on file. In the letter it states that Ebay distributed 1099-K of $228,563 and reported that amount to the IRS. However, I didn’t know until now that she gave her name, social security to her ex-boss to set up the ebay account. I filed the tax return for her, and of course it was $0 on schedule C. I consulted an CPA and he said the easiest way to fix this is to amend 1040X with schedule C. He said to offset the income with form 1099-misc paid to her ex-boss’s company. Is this doable?

That is dangerous territory Jeff.

You only have one-half of the equation, which is your girlfriend’s tax return. You don’t have her former boss’ return, so you don’t know how they filed–if they claimed the income or not.

Then, if you just now issue the 1099-MISC, the IRS will probably penalize her for filing so late.

Next, you have to consider the 1040X. It’s required that in addition to the corrected information you have to give a reason for the changes. That in and of itself may raise questions.

What it comes down to is the fact that it was in your girlfriend’s SSN, ao as far as the IRS is concerned it’s her money to pay tax on. That advice sounds pretty flippant and overly simplistic. Personally, I’d recommend speaking to a tax attorney on the matter since another party was the one who was supposed to be responsible for the tax liability. It The attorney is going to know how best to proceed in case the former boss needs to be approached.

So..I might be a bit late in this discussion but it would greatly help me if you can answer this question. I recently got a job not too long ago and filled out a W2. Now, for some off reason, my boss has been telling me that for the last 3 months, there was an “error” and unfortunately my info wasn’t properly logged into their system. He has paid me with a company check and has been doing so for the past 3 months. I am a bit concerned that they might report me on a 1099 at the end of the year and I’m quite clueless when it comes to this matters. He never mentioned anything in regards to being reported in a 1099, all he said was “I’m sorry, we were unable to log you in the system so we will pay you with a check”. Is this legal first of all? we never signed a contract and all conversations were verbal. Could someone help me?

my grandfather recently passed away on Sept of 2018 he had a floor covering company and was working as a contractor for a construction company, when he retired back in 2014 he passed his company to my uncle his oldest son who has been paying taxes for the company ever since. my grandmother just recently received a notice of outstanding debt to the IRS for 500,000.00 for taxes unpaid for the years 2015,2016 and 2017. upon contacting the IRS they tell her this major construction company send them a 1099-misc for the years mentioned listing her (a 78 yr old woman) as a contractor with their company. My grandmother has not worked since she married my grandfather back in the late 80s. we compared the amounts this company says they paid her with the amount my uncle received from them(my uncle who actually does work for them) and the amount are completely the same for those 3 years. We have gone to speak to the accountant that send these form to the IRS and she denies ever sending those 1099s , we asked her to give my grandmother a letter that states she never worked for them but they say they can’t with no explanation why. We asked the accountant to give her a corrected 1099-misc for the years 15-16-17 with amount of 0 so we can go to the IRS office but she still declined. My uncle did received his 1099s for those year and he already paid taxes for them. This to me smells of fraud and evasion of taxes by this company. how can we resolve this matter. please help!

I’m sorry for your loss, Claudia.

To be honest, this is something that needs to be taken up with an attorney. Or, at the very least, send a letter to the IRS explaining the situation as you have here, and tell them that you made honest attempts to get the situation cleared up with the company’s accountant but they won’t comply.

What about venmo? They don’t issue 1099-k to people and they don’t report to the IRS. So then venmo payments issue 1099-misc but not PayPal? Can you see how unclear this is?

Hey Matt!

If you are speaking of the receiving side, there is a very simple solution which I tell people all of the time–don’t rely on others to do your bookkeeping for you, meaning don’t wait until the end of the year and then say “These are all of the 1099s so the total is my gross income”. That’s incorrect because not all income is reported either on the 1099-MISC or the 1099-K and it’s up to you top track your income throughout the year.

Also, any service that is a qualified Payment Settlement Entity–the ones that send out 1099-Ks–will have you fill out a W-9 and log your tax id number for reporting purposes. So, that should also give you a little clarity as to whether you will be receiving a 1099 in either format.

If you are speaking to the unclear nature of who needs to send the 1099’s I address that specific issue on the article that is linked in the opening as well as the last section of this page. That specifically discusses Venmo, Zelle and any other personal payment services…again, neither of those services ask for you to fill out a W-9 which is the precursor to receiving a 1099-MISC/K.

I received a 1099-misc from Google. They are impossible to get a hold of, as is the holding company Adsense which generated the 1099. I have never done any business with Google (ie I do not have a pay pal account, do not advertise with google ,nor do I do surveys for pay). The IRS is just as hard to get hold of. The 1099 has my last 4 of my social and an account # that is supposed to be mine. If I can not get hold of the holding company (the # they have says it offers no support) what else can I do. I have tried e-mailing them and have been told to go to their help page and log in using my account #. Since I have no account with them it will not allow me to log in using the account # on the 1099! Feeling frustrated!

Hello Nancy.

Google accounts don’t use numbers, but rather your Google account or Gmail email address so trying to use any information from the 1099-MISC would not work. Generally there is an email address on the 1099 of [email protected], have you tried sending a message to that address (without giving any of your personal info aside from account number).

Also, the IRS is naturally going to take a while to get through to considering it’s tax season plus the government shutdown limited the number of workers actually available to handle things there. The main number is 800-829-1040 or you can make an appointment to visit your local office using this link https://apps.irs.gov/app/officeLocator/index.jsp

If you have tried to resolve the issue and think it’s an instance of identity theft, you should follow the steps in this resource https://www.irs.gov/newsroom/taxpayer-guide-to-identity-theft

Thanks for the help. The e mail for adsense came back as a failure. H and R block (they do our taxes) said it is probably a hoax since the 1099 only has the last 4 of my social instead of the whole #. They are going to include a memo to the IRS when we file this year. Again thanks for the help!

No problem Nancy!

I’m pretty sure it’s common practice for AdSense 1099s to mask the SSN–stars except for the last 4 digits–on forms mailed out to recipients. I have clients who received legitimate tax statements from Google and that was the same on theirs as well. That is an option for almost all platforms that help businesses file 1099s to make them more secure when being sent via postal mail (in case they get stolen or misdelivered the wrong party won’t have access to your entire SSN).

I don’t know your situation, but it seems odd that you would receive a fake Google 1099 containing your real information. I would hope that the people at H&R Block are trained well enough to know these things to help alleviate your fears regarding this type of thing. This just doesn’t smell like a scam to me to be honest.

They suggested that I send a copy of the 1099 back to the holding company with a letter stating that I had no income from them, and hope for a reply explaining why I received it. I will send it certified, signature required. They also looked up the payer’s federal ID number and it is from Google in countries other than the US. That I found really odd. The federal id # is 82-2182297 if you want to Google it…I hope I get a reply because now it has me really curious!

Actually, you can try using this form to request they void the form:

https://support.google.com/adsense/contact/tax_form_void_request

Thank you so much! I filled out the form as well as sending them a letter. You are a very helpful resource!

I received an ammended 1099 thanks to the info you provided…all fixed

Thant’s great news Nancy!

I received the same thing in the mail today. Never worked for or with Google on any business. Not able to contact the company in any way,

Hello Kathy.

I’m assuming you don’t own any websites that advertise using AdSense display ads or never sold an app or anything through the Google Play store?

Nope. I’m guessing some kind of fraud with someone using my name, address and SSN?

I would doubt that it’s identity theft–most instances of fraud don’t involve sending anyone a 1099-MISC with their correct info on it. Generally they will already have your name and address but need your SSN. But you never know these days!

You can try using this form to have them void the report:

https://support.google.com/adsense/contact/tax_form_void_request

Thank you. I have filled out the form to have it voided.

Kathy, I was wondering if anyone else had this happen!

In regards to Kathy and Nancy’s situation I had the exact same thing except mine is PayPal. All 2018 I’ve been dealing with identity theft and someone opening prepaid credit cards along with attempting opening a line of credit with PayPal. I was able to quickly get it shut down but since the Equifax breach I’ve been a victim of ID theft and now when I thought things were quieting down after freezing all my credit I get this 1099-K form for PayPal for over 8k of what I can only guess is some type of credit card or eBay sales. I DO NOT SELL ON EBAY AT ALL! So it amazes me this was so easy for them to do. It sounds so similar to their situation and is most definitely part of the ID theft so now what do we do to end this nightmare? I want to sue Equifax but a lawyer I consulted wants $200 an hour. I cannot afford this. Can Nancy, Kathy, and I join forces and get a lawyer or what because I have a feeling they are victims of Equifax breach too!!!

Hi Pete. I have had my credit checked by H and R Block ( we have used the same accountant there for 15 years, both for personal and business taxes), and we can find no accounts open that are fraudulent. We also can find no record of why I got this 1099!. We sent a certified/ signature required letter to the holding company that issued the 1099 misc. We also contacted Adsense through the link that Eric provided above. They have responded and are looking into it as well. Unfortunately there is no phone number that actually gets you to the company for support! I am curious how I received the 1099 at my home address, but never received any payment also. For now we are holding off on filing for last year until we figure this one out! My three credit reports show nothing being opened in my name for Google or Adsense, so I am hoping mine is just a mistake.

It’s important to remember 1 thing:

Credit reports will not show anything other than credit-related items or collections. That means credit/charge cards, auto loans, student loans, mortgages, and the like are the only things reported account-wise. The only other things that would possibly show up are collections/judgments against you such as utility deactivation or rental/medical bills sent to collections for failure to pay.

Nothing related to selling through eBay, Etsy or any other website or buying AdWords/selling AdSense space on your website will show up since they are not reported to the credit bureaus. Nothing related to your bank accounts will show up either.

What you should do if you are worried that your ID was compromised is to put a freeze on your credit via Experian, Equifax and TransUnion so that no one can open up any new trade lines under your SSN. That’s the only thing the credit bureaus will do for you with regard to this (aside from credit monitoring).

Or, you can check out myFICO for more information as well as all-encompassing tools in one location rather than going to a bunch of different sites.

Good advice. Credit Karma had all three of the phone numbers and web pages for all three companies. Again thanks for all of your help. I will let you know if/when we figure this out!

Yes, each bureau has information on how to do a freeze on the respective sites.

You can also keep an eye on the Inquiries section of your credit report. I don’t know if the Block person know about credit reporting, but that section will let you know rather quickly if any businesses pulled your credit report for anything ranging from cell phone service to bank accounts to lines of credit. That will show up much quicker than waiting to see what accounts are being reported because not all accounts are reported monthly (some are every other month) and none are done immediately. And, like I said earlier some things don’t show up on the credit report account listing at all.

We checked all the hard and soft inquiries…nothing fishy there in the past at all. I will freeze my credit as well and hope Adsense gets to the bottom of this. They did say that the federal id # on the 1099 is an Adsense/ Google # but they have yet to find my account number that is on the 1099. Again thanks for all the very helpful advice! I am so glad I found your site!!!

I received a 1099-misc with a total income that is $40000 more than I was paid. I was told to issue a 1099-misc back to the company for the $40000 amount as a business expense.

That didn’t sound right to me. So, I requested a correct 1099-misc that equal the amount of my direct deposits from that company. The 1099-misc must match the checks received right?

Hello Imad.

The response you received from the company is completely off base. It is not your responsibility to “fix” their error, especially when it would mean spending your own money to do so.

This was their error and the proper method to correct it is for them to file a new 1099-MISC with the correct dollar amount…and at their expense. If that doesn’t work, you should contact the IRS, inform the agent you speak to of your attempts to get this resolved and let the agency go to them.

Of course, I’m assuming you aren’t a corporation and you got paid either via cash, check or transfer service such as Venmo or Zelle. If you were paid via credit card or PayPal–or are a C/S-Corp– then you shouldn’t be getting a 1099-MISC anyway.

Either way, good luck in getting this fixed!

Thanks.

what needs to be in a letter to business, if they are claiming they paid you more than they actually did

Hello Kristal.

The simplest thing to do would be to explain the situation and list the dates, amounts and method of the payments you received. That way the company can match it up to their records and see where the discrepancy is.

Hi, I received a 1099Misc form from my employer. He asked me to go on side jobs to Leidl to make extra money and 2 days ago told me I now owe the irs money. But on the form its the same address as my work place and he listed me as a nonemployee but I am his employee. Plus he added the lump some of money in with my regular check. I don’t know what to do.

I’m sorry you are dealing with this confusion Kayla.

First let me ask if the 1099-MISC shows the name and EIN of the business or if it was your boss’ name and SSN in the Payer’s section (top)? If it’s the latter then it makes sense because he was paying you to run his personal errands and in that case you aren’t an employee.

Second, it sounds like you are saying that you received the money for the side-job in your regular paycheck and you received it again when you completed each task.

It sounds to me like you need to sit down with your boss and lay out what was paid and for what and then decide whether or not he should be filing a $0 1099-MISC to fix it or if what he originally filed was correct.

I have great credit, no mortgage, paid off credit cards but just recieved a fraudulent 1099 from Bayview Loan Servicing, LLC, 4425 Ponce De Leon Blvd, 5th Floor, Coral Gables Fl 33146 for $4950.00. Looking online, they are scammers but what do I do? Call them? They have the last 4 of my social listed on the 1099. How do I handle please?

Hello Laura!

Without knowing what kind of 1099 it was (there are many different versions–Int, Div, MISC, etc) I can’t give you very much info. What I can suggest would be to definitely call them and ask why you are receiving that form. Tell them that you don’t recall having any dealings with their company and if they can’t explain where they got your information from in a manner you are satisfied with, ask them to file a corrected $0 form. Make sure to records the date, time and names of the people you spoke to.

If that doesn’t work, you an always call the IRS, tell them of your situation and your attempts to get it resolved and let them give you further guidance or step in. You just have to make an attempt on your own first before turning to them.

Eric, I did some work for a company in 2018, but have only been paid for half of what was agreed. I think they intend to pay me soon for the balance. Should they be sending me a 1099 for only the amount that paid in 2018, or the full amount? What is the rule here? Many thanks.

Hey Jason!

Your 1099-MISC should only report what you were actually paid between 1/1/18 and 12/31/18. if more is reported on there then you need to tell them to file a corrected 1099-MISC reporting only the actual payments.

Hi and thanks for your work I send a message probably two months ago don’t see a response on here but I don’t check my email much 11 months ago in April my boss who owned the company sold it for millions of dollars the new company laid me off and he no longer was employed there also but he said he would give me $50,000 as a gift to help me out if he sold the company wrote a piece of paper with that on it after the closing about two weeks later open a separate account and had some temporary checks and wrote me a check for $50,000 and and I went on unemployment I’m trying to find a new job no just received a 1099 from him in the name of his company he made from his home address which is just where he has money JP Holdings 1099 miscellaneous box number 7 non-employee $50,000 I already did my taxes 2 weeks ago and knew I didn’t have to claim a gift as income what should I do now do I have to pay taxes because I received a 1099 that I believe was fraudulent

Hello John!

I apologize, but what you need to do is find yourself a good attorney. Since you have documentation of this arrangement, that falls into the legal territory, not accounting or tax areas.

Good luck!

Unfortunately an attorney cost $1,000 an hour I’m not sure how he got my social security number and address to send me the 1099 when he could have just filed the 709 gift tax form but I called his tax guy and he told me he claimed the money for a write off not sure if I should call the IRS and explain it to him I already did my taxes but I don’t want to wait around for them to call me and then have to pay a bunch of penalties basically his word against mine I went to the bank and got a copy of the check nothing in the memo margin and he lied and said that I gave him the address of where I live in my social security number when he gave me the check which he never asked me and I never gave it to him so he probably went to the company records and got it somehow he has Mayan $2 and I am just now starting a new job anything else you can suggest or should I just call the IRS I tell them what’s going on not sure if they’ve even received the 1099 yet

Again, I’m sorry for your situation, but this isn’t the right place to be seeking help.

You need to get professional assistance, and $1k/hr seems quite high regardless of where you live. You can try calling the IRS for guidance but they will 99% tell you that you need to engage an attorney since it’s a legal issue due to the contract.

Hello Eric

My husband received 1099 misc from his former employee, for an amount less than $3000. He also received W2, right now he’s confused cos he was never paid without been taxed while he was working with his former employer, and no other allowances were paid that should require a 1099 misc. He contacted his former employer and the employer sounded , and said he’ll get back to him, but we haven’t heard from him. It must have been an error. Pls what should he do. Cos i don’t want my husband to pay for what he didn’t earn in the first place.

Hello Lizzy.

This is something that needs to be taken care of between your husband and the employer. There has to be a reason for the 1099-MISC in addition to the W-2. People generally don’t waster their time and money filing documents that are made-up.

If the employer doesn’t give you any information, then you an call the IRS and file a complaint stating that you believe this is in error and you’ve attempted to work it out with the employer but they ignored your attempts.

Let’s say my employer who i worked with report my income in 1099 form incorrectly. So instead of 3000, i received a 1099 form from him stated that my income is 5000. I called and I know he not gonna change it due to issue arise between us when we work together. So what i need to do now? Thanks

What you need to do is to speak to him. You need to explain to him that if you report less on your tax return than what was reported to the IRS by your “employers” then the IRS will come back to you looking to know why you aren’t showing that amount. Also let him know that you can’t just “report what he put” because you never received that money and the taxes on that amount are rather large.

It is his duty to accurately report your earnings on the 1099-MISC…if he refuses to fix it, then you should contact the IRS and inform the agent you speak with about the situation. Tell them you made an attempt to resolve the situation and they will likely contact him to have the 1099-MISC corrected.

Hi. My husband has worked for his grandparents oilfield co since 1998. They allow payday advances that are withheld from the paycheck at whatever amount is reasonable. In 2012 his gma switched accountant’s. That was the first time we received a 1099. We were confused because we did not knoww what that was and at that time in our life my husband’s family was hard to communicate with so we were never able to get an answer from them so a friend referred us to her tax people they were supposed to be experts. It was day before final tax day because we had been trying to get an answer from family so we waited until the last minute. Picked up returns the following day and were told we owed a little over 2 grand to feds and about 1,000 to state because of 1099. We have gotten one every year since and every year it’s a fight as to why. In 2014 out of the blue the state started garnishing my checks stating we owed gross receipts from 2012. After penalties and fines and what they calculated we owed in taxes it came to over 6,000 they said we owed. My husband’s 19 yr old baby brother had died just a few months earlier and we were in no position to fight we just said ok. From 2013 to now we have used a different accountant and she files the 1099’s and we owe but never in the thousands and the IRS hasn’t had issue with any. So I feel the people in 2012 filed our stuff incorrectly resulting in all this mess. I am on short term disability which means they can’t garnish my paycheck at the moment so Friday the IRS cleaned out our bank account and savings. Then we received a notice from the feds stating we owe a lot of money to them because of that 1099 from 2012. This yr we did not get one. The issue ended up being that the accountant would withhold the advance along with taxes for the advance but then was issuing us a 1099 every year for the cash advances. Sorry lots of details. What can we do?

Hello Brandy.

I’m sorry you are dealing with this situation. What you need to do is hire a Tax Attorney or a CPA with experience with back-taxes to go over everything from the beginning until now. It’s not going to be easy and it will cost some money but you don’t have much of a choice in the matter if you want to get out from under this.

I received a 1099 misc for 4430.00 they only paid me 500. They never made the final payment for work. I called them and gave the check number an amount. I still have the open invoice for not being paid. They won’t send out another 1099 and pretty much said it’s my problem. They did say they see the CK number for the 500 than said their department says it was paid. I asked for email of final check an payment and they said they don’t have it. What should I do?

Hello Mike.

I would write down all of the details regarding who and when before you forget. Then call them again and tell them that it’s not your problem, but theirs to fix as they cannot report more money on a 1099-MISC than they physically paid you. Let them know that all they have to do is file another 1099-MISC with that correct $500 amount on it, nothing more nothing less.

Again, record the who and when. If they still refuse, call the IRS and give the agent all of that info and let them know you made every attempt to get the company to correct the situation on your own. The IRS agent will then either give you further instructions or will send a notice to the company.

On top of that, if you have a contract and the invoice you can even speak to a business/contract attorney to force them to pay.

So here is my situation…I applied for a grant (on behalf of my 82 year old mother in law) to assist her with her mobile home skirting. SHE was awarded the grant $1000 and all went towards the purchase of materials. I guess since I filed for hte grant I received a 1099-misc for $1000. As stated; the entire amount went towards materials I received nothing for my labor. What can I do? Thanks

Hey Dan.

It sounds like you answered your own question–since you applied for the grant you received the 1099-MISC. Who it was ultimately for or what the use was are inconsequential because it was your info on the application and grants aren’t tax-free money outside of educational-specific grants. I have a feeling the tax-reporting responsibility was in the terms of the application–same as if you win a contest.

There really isn’t anything you can do at this point except pay the taxes. The money spent can be added to the basis of the home for when it’s sold, but that’s pretty much it.

Hello, My daughter received a 1099t form from her grandmother showing she paid her $5000.00, which was not true. My daughter needed to borrow $1000.00 her grandmother told her that she could come work for her to pay the money back. Well to make a long story short after my daughter work for her grandmother for 2 months without pay, on the third month my daughter grandmother started to pay her in cash, my daughter only work for her for a total of 4 months, two months was without pay and the other two months was with pay. How can you give my daughter a 1099t from showing she paid her $5000.00 when she never paid her that much money?

Hello Crystal.

First, a 1099t isn’t a thing…there is a 1098-T but that is for tuition from post-secondary educational institutions. If you are talking about a 1099-MISC, that is an issue you need to address with the family member. If you an’t work it out the only thing you an do is call the IRS and explain the situation but they will most likely call your relative and inquire about the situation so it’s going to be a messy situation either way.

Hello!

My husband was hired to do a commercial photo shoot for a large (national) company in late 2018. The original shoot date was cancelled and rescheduled for a new date in 2019. No payment for the job was made. We just received a 1099 for the original bid amount, even though we never received payment. The company had issued a check for payment and whomever was supposed to send it instead held it and then had it voided in January. Now the company is telling us this is our problem to work out with a CPA because the check was “in transit” in 2018 and therefore the $ was allotted to us so they have to claim it. The check was never “in transit” – it never left their offices. What are we supposed to do? My husband didn’t do the job, he wasn’t paid for it, but somehow it’s our problem that they filed a 1099 on us?

Hi Dawn.

You just have to call the person your husband was working with or the accounting department and tell them that the simple fact is that they never paid him and can’t show proof of their “payment” being cashed/received because it was never sent. That just goes to show it’s their own problem.

Let them know this is a clear-cut issue of them simply needing to send in a $0 1099-MISC in your husband’s name to the IRS, and you are giving them every opportunity to correct the error they made. If not, you should call the IRS inform the agent of the issue in detail, including the fact that you made two honest attempts to solve it yourself with the company. They will most likely then send a letter of inquiry to the company and see what the other side has to say.

My husband is an employee and receives royalties for each game sold in addition to his base compensation. He received a W2 AND a 1099-MISC but this doesn’t seem right – shouldn’t the payout be viewed as an employee bonus and not 1099-MISC royalties? None of this was completed as a contractor or in any manner of self-employment.

Hello Ashley.

Unfortunately, there is not enough context in your message to fully understand the situation. Is he a salesperson in a store? Is he a creator/co-creator of these games? Is this a wholesale company?

What you need to do is have your husband go over his contract with the employer–if there is one. If there isn’t, then he should sit down with the HR department or whoever is in charge of payroll/employees and go over the details of his pay and structure.

No one is going to be able to answer your questions unless they have all of the information–and most likely you would be best served by speaking to an employment attorney.

I work for a firm. I received a 1099 for cases I handled. My employer actually gets the checks and pays me a salary. My employer claims all of the 1099 income (mine and hers) on her business taxes. The IRS comes back to me saying the numbers aren’t matching even though I attach a nominee statement. I’m not sure how else to file it and no one at H&R help line could tell me what to do. I sent a statement to the IRS explaining how my employer actually claimed and paid the taxes and received a letter back just saying they received my response and were looking into it. I don’t know what else to do and am terrified of course.

Hi Amber!

At this point, all you can do is wait for the IRS to take your response into consideration. The agent assigned will come back to you and tell you what the determination is but it can take weeks or even months.

I don’t have enough information to give you any advice, other than do let the process work itself out and then learn from whatever it was that you did wrong to get the “mismatched income reporting” letter from the IRS.

Received a w2 and a 1099 from same employer